Kentucky VA Home Loans offered by a Kentucky Veteran. I have successfully originated over 100 VA Kentucky Mortgages for fellow Kentucky Veterans and active duty personnel.$0 Down Home loans in KY. Free Credit Report and free pre-approvals. I can be reached by text or call at 502-905-3708, or kentuckyloan@gmail.com Not affiliated with VA Government Agency. NMLS #57916 Company NMLS #1738461 Former Army Tanker 19k

Pages

- How to Apply for a Kentucky VA Loan

- Accessibility Statement

- KENTUCKY AND LOUISVILLE VA APPROVED CONDOS

- Things needed for a Kentucky VA Mortgage Loan Approval

- Customer Reviews/Testimonials

- Kentucky VA Home Loan Mortgage New Construction

- Refinancing Louisville Ky VA Loans

- Home

- Privacy And Disclosures

- Mortgage Application Process

- Certificate of Eligibility

- Kentucky VA Loan Requirements

- VA home loan

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgages: Kentucky VA Mortgage Loan Information

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgages: Kentucky VA loans Compared to Kentucky USDA, FHA, ...

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgages: Getting your Louisville Kentucky VA Loan Approval.

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgages: Why Kentucky Mortgage Loans Are Denied

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgages: Key ways to get your best rate possible on your Ke...

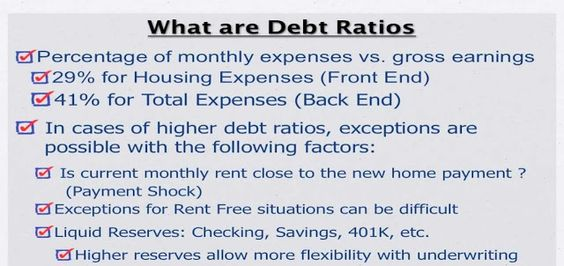

Debt-to-Income (DTI) ratio requirements for Kentucky FHA, VA, USDA, and conventional mortgage loans

Here's a summary of the Debt-to-Income (DTI) ratio requirements for Kentucky FHA, VA, USDA, and conventional mortgage loans, along with examples for each:

Kentucky FHA Loan DTI Requirements:

- Front-End DTI Ratio: Up to 31%

- Back-End DTI Ratio: Up to 43%

- Example: Monthly gross income of $5,000, the FHA loan allows a maximum monthly mortgage payment (including principal, interest, taxes, and insurance) of $2,150 (43% of $5,000).

Kentucky VA Loan DTI Requirements:

- Generally flexible with DTI ratios, but a common guideline is:

- Back-End DTI Ratio: Up to 41%

- Example: Monthly gross income of $6,000, the VA loan allows a maximum monthly debt payment (including mortgage, car loans, credit cards, etc.) of $2,460 (41% of $6,000).

- Generally flexible with DTI ratios, but a common guideline is:

Kentucky USDA Loan DTI Requirements:

- Front-End DTI Ratio: Up to 29%

- Back-End DTI Ratio: Up to 41%

- Example: Monthly gross income of $4,000, the USDA loan allows a maximum monthly mortgage payment (including taxes and insurance) of $1,160 (29% of $4,000).

Kentucky Conventional Loan DTI Requirements:

- Front-End DTI Ratio: Up to 28%

- Back-End DTI Ratio: Up to 36-45% (may vary based on the lender and loan program)

- Example: Monthly gross income of $7,000, a conventional loan may allow a maximum monthly debt payment (including mortgage, car loans, credit cards, etc.) of $2,520 to $3,150 (36-45% of $7,000).

How to calculate your front-end DTI for a Kentucky Mortgage Loan Approval

How lenders use your DTI for a Kentucky Mortgage Loan Approval

Hope your day is full of sunshine

Joel Lobb Mortgage Loan Officer

American Mortgage Solutions, Inc.10602 Timberwood Circle

Louisville, KY 40223

Company NMLS ID #1364

Text/call: 502-905-3708

fax: 502-327-9119

email: kentuckyloan@gmail.com

http://www.mylouisvillekentuckymortgage.com/

NMLS ID# 57916, (www.nmlsconsumeraccess.org).