Here's a summary of the Debt-to-Income (DTI) ratio requirements for Kentucky FHA, VA, USDA, and conventional mortgage loans, along with examples for each:

Kentucky FHA Loan DTI Requirements:

- Front-End DTI Ratio: Up to 31%

- Back-End DTI Ratio: Up to 43%

- Example: Monthly gross income of $5,000, the FHA loan allows a maximum monthly mortgage payment (including principal, interest, taxes, and insurance) of $2,150 (43% of $5,000).

Kentucky VA Loan DTI Requirements:

- Generally flexible with DTI ratios, but a common guideline is:

- Back-End DTI Ratio: Up to 41%

- Example: Monthly gross income of $6,000, the VA loan allows a maximum monthly debt payment (including mortgage, car loans, credit cards, etc.) of $2,460 (41% of $6,000).

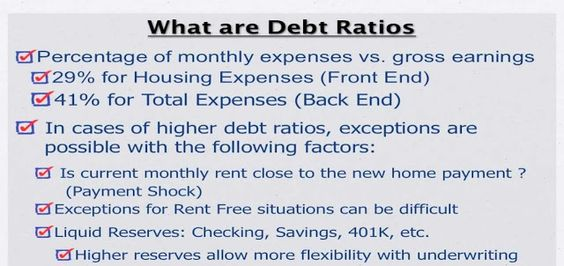

Kentucky USDA Loan DTI Requirements:

- Front-End DTI Ratio: Up to 29%

- Back-End DTI Ratio: Up to 41%

- Example: Monthly gross income of $4,000, the USDA loan allows a maximum monthly mortgage payment (including taxes and insurance) of $1,160 (29% of $4,000).

Kentucky Conventional Loan DTI Requirements:

- Front-End DTI Ratio: Up to 28%

- Back-End DTI Ratio: Up to 36-45% (may vary based on the lender and loan program)

- Example: Monthly gross income of $7,000, a conventional loan may allow a maximum monthly debt payment (including mortgage, car loans, credit cards, etc.) of $2,520 to $3,150 (36-45% of $7,000).

How to calculate your front-end DTI for a Kentucky Mortgage Loan Approval

Your front-end DTI is calculated by dividing your monthly housing costs by your monthly gross income. Front-end DTI for renters is simply the amount paid in rent, whereas for homeowners it is the sum of mortgage principal, interest, property taxes, and home insurance (i.e., your PITI) divided by gross monthly income. From above, if that $2,800 in debt payments is attributable to $1,500 in housing costs and $1,300 in non-housing costs, then your front-end DTI is $1,500/$5,000 = 30% (and your back-end ratio is still 56%, as calculated above).

How lenders use your DTI for a Kentucky Mortgage Loan Approval

Kentucky Mortgage lenders typically use DTI (along with other variables) to determine whether or not you qualify for a loan, and to help determine your Kentucky mortgage rate. A high front-end DTI raises red flags with lenders because it is commonly associated with borrower default. In fact, reducing front-end DTI to reduce the risk of homeowner default was one of the main objectives of the loan modification programs introduced by the government in 2009. There are specific limits for DTI that are used as cut-off points when evaluating borrowers. Current DTI limits for conventional conforming mortgage loans are typically 28% on the front end and 36% on the back end, though these limits are slightly higher for government subsidized Kentucky FHA loans.

While there are certainly other factors to consider when determining our eligibility for financing (e.g., credit score, etc.), your DTI is an important determinant that you should be aware of. By working to improve it, you can make yourself a better credit risk, and thus get more favorable treatment from lenders.

Hope your day is full of sunshine

Joel Lobb Mortgage Loan Officer

American Mortgage Solutions, Inc.10602 Timberwood CircleLouisville, KY 40223Company NMLS ID #1364Text/call: 502-905-3708

fax: 502-327-9119

email: kentuckyloan@gmail.comhttp://www.mylouisvillekentuckymortgage.com/

NMLS 57916 | Company NMLS #1364/MB73346135166/MBR1574

The view and opinions stated on this website belong solely to the authors, and are intended for informational purposes only. The posted information does not guarantee approval, nor does it comprise full underwriting guidelines. This does not represent being part of a government agency. The views expressed on this post are mine and do not necessarily reflect the view of my employer. Not all products or services mentioned on this site may fit all people.NMLS ID# 57916, (www.nmlsconsumeraccess.org).