Kentucky VA Home Loans offered by a Kentucky Veteran. I have successfully originated over 100 VA Kentucky Mortgages for fellow Kentucky Veterans and active duty personnel.$0 Down Home loans in KY. Free Credit Report and free pre-approvals. I can be reached by text or call at 502-905-3708, or kentuckyloan@gmail.com Not affiliated with VA Government Agency. NMLS #57916 Company NMLS #1738461 Former Army Tanker 19k

Pages

- How to Apply for a Kentucky VA Loan

- Accessibility Statement

- KENTUCKY AND LOUISVILLE VA APPROVED CONDOS

- Things needed for a Kentucky VA Mortgage Loan Approval

- Customer Reviews/Testimonials

- Kentucky VA Home Loan Mortgage New Construction

- Refinancing Louisville Ky VA Loans

- Home

- Privacy And Disclosures

- Mortgage Application Process

- Certificate of Eligibility

- Kentucky VA Loan Requirements

- VA home loan

Showing posts with label VA Guidelines. Show all posts

Showing posts with label VA Guidelines. Show all posts

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgages: Kentucky VA Mortgage Loan Information

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgages: Kentucky VA Mortgage Loan Information: Kentucky VA Mortgage Loans What are VA Home Loans? VA Loans provide military veterans and current service members a distinct advan...

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgages: Kentucky VA Mortgage Qualifying Guidelines

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgages: Kentucky VA Mortgage Qualifying Guidelines: NMLS ID. 57916, NMLS ID. 1364 EQUAL HOUSING LENDER CALL/TEXT 502-905-3708 www.nmlsconsumeraccess.org subject to credit and income qualifyi...

- Min 580 FICO (Refer /Eligible thru DU or LP)- Refer Eligible

- 580 + Cash Out Refi's up to 100% (approved eligible)

- No DTI cap - follow AUS findings

- VA- REFER/ELIGIBLE - 50% max ratio

- No VOR unless required by DU findings (unless VA Refer)

Kentucky VA Mortgage Refinance

Kentucky VA Mortgage Refinance Guidelines |

|

Kentucky VA Mortgage Guidelines for Student Loan Payments

Clarification and New Policy for Student Loan Debts and Obligations

1. Purpose. The purpose of this Circular is to clarify and explain new policy regarding

student loans for the underwriting of Department of Veterans Affairs (VA) guaranteed home

loans.

2. Background. The policy in the Lender’s Handbook- VA Pamphlet 26-7, chapter 4, section 5,

paragraph G will now be titled Student Loans. The clarification will apply to deferred student

loans and the new policy will provide guidance for student loans in repayment or, to begin

repayment within 12 months of a VA loan closing. Student loans under certain repayment plan

types are described at studentaid.ed.gov. This policy applies to all student loan repayment types.

3. How to Calculate a Student Loan Monthly Payment.

a. If the Veteran or other borrower provides written evidence that the student loan debt will be

deferred at least 12 months beyond the date of closing, a monthly payment does not need to be

considered.

b. If a student loan is in repayment or scheduled to begin within 12 months from the date of

VA loan closing, the lender must consider the anticipated monthly obligation in the loan

analysis and utilize the payment established in paragraph (1) or (2) below. Calculate each loan

at a rate of 5 percent of the outstanding balance divided by 12 months (example: $25,000

student loan balance x 5% = $1,250 divided by 12 months = $104.17 per month is the monthly

payment for debt ratio purposes).

(1) The lender must use the payment(s) reported on the credit report for each student loan(s) if

the reported payment is greater than the threshold payment calculation above.

(2) If the payment reported on the credit report is less than the threshold payment calculation

above, the loan file must contain a statement from the student loan servicer that reflects the

actual loan terms and payment information for each student loan(s). The statement(s) must be

dated within 60 days of VA loan closing and maybe an electronic copy from the student loan

servicer’s website or a printed statement provided by the student loan servicer. It is the

lender’s discretion as to whether the credit report should be supplemented with this information

Text/call 502-905-3708

kentuckyloan@gmail.com

1. Purpose. The purpose of this Circular is to clarify and explain new policy regarding

student loans for the underwriting of Department of Veterans Affairs (VA) guaranteed home

loans.

2. Background. The policy in the Lender’s Handbook- VA Pamphlet 26-7, chapter 4, section 5,

paragraph G will now be titled Student Loans. The clarification will apply to deferred student

loans and the new policy will provide guidance for student loans in repayment or, to begin

repayment within 12 months of a VA loan closing. Student loans under certain repayment plan

types are described at studentaid.ed.gov. This policy applies to all student loan repayment types.

3. How to Calculate a Student Loan Monthly Payment.

a. If the Veteran or other borrower provides written evidence that the student loan debt will be

deferred at least 12 months beyond the date of closing, a monthly payment does not need to be

considered.

b. If a student loan is in repayment or scheduled to begin within 12 months from the date of

VA loan closing, the lender must consider the anticipated monthly obligation in the loan

analysis and utilize the payment established in paragraph (1) or (2) below. Calculate each loan

at a rate of 5 percent of the outstanding balance divided by 12 months (example: $25,000

student loan balance x 5% = $1,250 divided by 12 months = $104.17 per month is the monthly

payment for debt ratio purposes).

(1) The lender must use the payment(s) reported on the credit report for each student loan(s) if

the reported payment is greater than the threshold payment calculation above.

(2) If the payment reported on the credit report is less than the threshold payment calculation

above, the loan file must contain a statement from the student loan servicer that reflects the

actual loan terms and payment information for each student loan(s). The statement(s) must be

dated within 60 days of VA loan closing and maybe an electronic copy from the student loan

servicer’s website or a printed statement provided by the student loan servicer. It is the

lender’s discretion as to whether the credit report should be supplemented with this information

Joel Lobb (NMLS#57916)

Senior Loan Officer

Senior Loan Officer

American Mortgage Solutions, Inc.

10602 Timberwood Circle Suite 3

Louisville, KY 40223

Company ID #1364 | MB73346

Text/call 502-905-3708

kentuckyloan@gmail.com

Disclaimer: No statement on this site is a commitment to make a loan. Loans are subject to borrower qualifications, including income, property evaluation, sufficient equity in the home to meet Loan-to-Value requirements, and final credit approval. Approvals are subject to underwriting guidelines, interest rates, and program guidelines and are subject to change without notice based on applicant's eligibility and market conditions. Refinancing an existing loan may result in total finance charges being higher over the life of a loan. Reduction in payments may reflect a longer loan term. Terms of any loan may be subject to payment of points and fees by the applicant Equal Opportunity Lender. NMLS#57916 http://www.nmlsconsumeraccess.org/

-- Some products and services may not be available in all states. Credit and collateral are subject to approval. Terms and conditions apply. This is not a commitment to lend. Programs, rates, terms and conditions are subject to change without notice. The content in this marketing advertisement has not been approved, reviewed, sponsored or endorsed by any department or government agency. Rates are subject to change and are subject to borrower(s) qualification.

What are the eligibility requirements for a VA Loan in Kentucky?

What are VA Home Loans?

VA Loans provide military veterans and current service members a distinct advantage when it comes time to purchase or refinance a home. Today’s VA Loans have the most favorable terms available for most veterans. VA Loans can be used to purchase a new home with no down payment with no mortgage insurance or refinance up to 90% of a homes current equity.

What are the eligibility requirements for a VA Loan in Kentucky?

Veterans Affairs loan guidelines use two methods of income qualification in Kentucky. The residual income method is the primary method, where it is determined that the borrower has sufficient income to cover daily living costs once housing, taxes, insurance and all other liabilities like credit card and auto payments have been made. Additionally, VA loans use a debt to income ratio (DTI). Using this ratio, the veteran’s total debt should not exceed 41% of the veteran’s total income. Most lenders will require at least a 620 credit score for a VA Loan approval. VA does not have a minimum credit score requirement, but lenders do.How much can I borrow?

The maximum VA Mortgage amount is determined by:

Maximum Finance: For purchase transactions, the Maximum VA Loan will be 100% of the lower of the selling price or the appraised value

What property types are allowed for VA Loans in Kentucky

VA Loans may be used to purchase or refinance single family residences and VA approved condo projects if the property is the veteran’s primary residence.

Can I do a VA refinance in Kentucky?

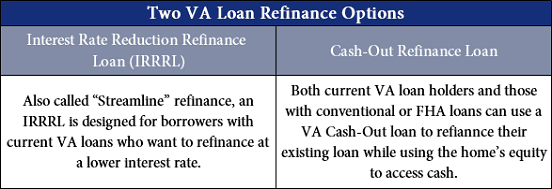

Three kinds of VA Refinance programs are available for veterans in Kentucky.

Rate/Term VA Refinance

The Rate/Term VA Refinance can be used to refinance a conventional, FHA or subprime mortgage into a stable, fixed rate VA Loan.VA Cash-Out Refinance

A Cash-Out VA Refinance is very beneficial for the veteran who wants to access the equity that they have built up in their home. VA Loans can be used to refinance up to 90% of a homes current value and take cash out for any reason.

Streamline Refinance

The VA Streamline Refinance is designed to lower the interest rate on a current VA mortgage or convert a current VA adjustable rate mortgage into a fixed rate. A VA Streamline Refinance Loan can be performed quickly and easily. It requires much less hassle and paperwork than a normal refinance including no appraisal, no qualifying debt ratios and no income verification.What factors determine if I am eligible for a VA Refinance Loan?

VA refinance loans use two methods for income qualification purposes in Kentucky. The residual income method is the primary method, where it is determined that the borrower has sufficient income to cover daily living costs once housing, taxes, insurance and all other liabilities like credit card and auto payments have been made. Additionally, VA loans use a debt to income ratio (DTI). Using this ratio, the veteran’s total debt should not exceed 41% of the veteran’s total income. Most lenders will require at least a 620 credit score for a VA Loan approval even though VA states in their guidelines it has no minimum credit score.Why choose a VA Home Loan?

Kentucky VA Mortgages require no down payment.

There are no prepayment penalties for VA Home Loans.

An Kentucky VA Loan is fully assumable, provided the person assuming is qualified.

VA Mortgage Loans have no PMI premiums.

A VA Mortgage Loan is eligible for non-credit qualifying, Streamline Refinance or “IRRRL”.

A VA Home Mortgage is available all areas of the country, provided a market exists for the property and the home meets VA’s property standards.

A VA Home Loan may be used to purchase or refinance a new or existing home.

Kentucky VA Loans are offered at terms of 15 or 30 years.

VA Loans in Kentucky

10 facts about the Kentucky VA Home Loan program

1. No down payment, no mortgage insurance

These are perhaps the biggest advantages to a VA loan. You don’t need a down payment. None whatsoever. Most mortgage programs, such as FHA and conventional loans, require at least 3.5 percent to five percent down.That’s up to $12,500 on a $250,000 home purchase.

With a VA loan, you can buy immediately, rather than years of saving for a down payment. With a VA loan, you also avoid steep mortgage insurance fees. At 5 percent down, private mortgage insurance (PMI) costs $150 per month on a $250,000 home, according to PMI provider MGIC.

With a VA loan, this buyer could afford a home worth $30,000 more with the same monthly payment, simply be eliminating PMI. Using a VA loan saves you money upfront, and tremendously increases your buying power.

2. Use your benefit again and again

Your VA home loan benefit is not one-and-done. You can use it as many times as you want. Here’s how.

Assume you purchased a home with a VA loan. But now, you’ve outgrown the home and need something bigger. When you sell the home and pay off the VA loan completely, you can re-use your benefit to buy another home. Your entitlement is restored in full.

But that’s not the only way to re-use your benefit.

Eligible Veterans and Service persons can receive a one-time restoration when they pay off the VA loan, but keep the home. This scenario comes into play if you purchased the home long ago, and have paid off the loan. It also applies if you have refinanced the VA mortgage with a non-VA loan.

In these cases, you can keep the home, and enjoy the benefits of VA home buying one more time.

3. Your benefit never expires

Once you have earned eligibility for the VA home loan, it never goes away. Those who served 20, 30, even 50 years ago often wonder whether they can still buy a home today if they never used their benefit. If eligibility can be established, the answer is yes.

Eligibility is based on the length of time served, and the period in which you served. For instance, a U.S. Army Veteran with at least 90 days in service during the Vietnam era is likely eligible.

To check eligibility, first obtain your DD Form 214. With that document, a VA-approved lender can request your VA Certificate of Eligibility for you, or you can request it directly from VA’s eBenefits website. You may be eligible to buy a home using a VA home loan, even if you served long ago.

4. Surviving spouses may be eligible

More than 3,000 surviving spouses purchased a home with their fallen partner’s VA benefit in 2015. Un-remarried husbands and wives of Service-persons who were killed in action can buy a home with zero down payment and no mortgage insurance. Plus, the VA funding fee is waived.

There’s no way to repay the spouse of a fallen hero, but this benefit surely helps them move forward after tragedy.

5. VA Loan Rates Are Lower

According to loan software company Ellie Mae, VA loan rates are typically about 0.25% lower than those of conventional loans. The VA backs the mortgages, making them a lower risk for lenders. Those savings are passed on to Veterans.

Additionally, VA loans come with some of the lowest foreclosure rates of any loan type, further reducing risk for lenders. No surprise here, but Veterans and Service persons take home ownership seriously. These factors add up to lower rates and affordable payments for those who choose a VA loan.

6. VA loans are available from local lenders

The VA home loan is unlike most other VA benefits. This benefit is available from private companies, not the government itself. The Department of Veterans Affairs does not take applications, approve the loans, or issue funds. Private banks, credit unions, and mortgage companies do that.

The VA provides insurance to lenders. It’s officially called the VA guaranty. The VA assures the lender that it will be repaid if the Veteran can no longer make payments. In turn, lenders issue loans at superior terms. In short, a VA loan gives you the best of both worlds. You enjoy your benefit, but have the convenience and speed of working with your chosen lender.

7. Buy, refinance or tap into home equity

The VA home loan benefit is not just for buying homes. Sure, it provides unmatched home buying advantages, but you can also use it to refinance your existing mortgage, whether it’s a VA loan or not.

Homeowners with a VA loan can use the Interest Rate Reduction Refinancing Loan, or IRRRL, to easily drop their rate and payment without an appraisal, or even paystubs, W2s or bank statements. The VA streamline refinance, as it is commonly known, gives VA loan holders a faster, cheaper way to access lower refinance rates when rates fall.

Even homeowners without a VA loan can use a VA refinance. The VA cash-out loan is available to eligible Veterans who don’t have a VA loan currently. As its name suggests, a VA cash-out refinance can be used to turn your home’s equity into cash. You simply take out a bigger loan than what you currently owe. The difference is issued to you at closing.

The VA cash-out loan amount can be up to 100 percent of your home’s value in many cases. Use the proceeds for any purpose – home improvements, college tuition, or even a new car.Many homeowners today are dropping their rate and taking cash out simultaneously, accomplishing two goals at once.

But you don’t have to take out cash to use this VA loan option. You can also use it to pay off a non-VA loan. Eligible homeowners who pay mortgage insurance or are dealing with other undesirable loan characteristics should look into refinancing with a VA loan. It can eliminate PMI, get you into a stable fixed-rate loan, pay off a second mortgage, or simply reduce your rate to make homeownership more affordable.

8. Lenient guidelines for lower credit scores, bankruptcy, foreclosure

Unlike many loan programs, a lower credit score, bankruptcy or foreclosure does not disqualify you from a VA home loan.

Shop around at various lenders, because each will have its own stance on past credit issues. However, VA guidelines do not state a minimum credit score to qualify. This gives lenders leniency to approve loans with lower scores. In addition, VA considers your credit re-established when you have established two years of clean credit following a foreclosure or bankruptcy.

Many homeowners across the U.S., military and civilian, experience bankruptcies and foreclosures due to a loss of income, medical emergency or unforeseen event. Fortunately, these financial setbacks don’t permanently bar VA-eligible home buyers from ever owning again.

The exception, though, is a foreclosure involving a VA home loan. In this case, you may need to pay back the amount owed on the foreclosed VA loan to regain eligibility. But for most home buyers with past credit issues, a VA home loan could be their ticket to home ownership.

9. Funding fee waivers

VA typically charges a funding fee to defray the cost of the program and make home buying sustainable for future Veterans. The fee is between 0.50 percent and 3.3 percent of the loan amount, depending on service history and the loan type.

However, not everyone pays the VA funding fee. Disabled Veterans who are receiving compensation for a service-connected disability are exempt. Likewise, Veterans who are eligible for disability compensation, but are receiving retirement or active duty pay instead, are also exempt from the fee.

10. Buy a condo with a VA loan

You can buy many types of properties with a VA loan, including a single-family (free-standing) home, a home of up to four units, and even manufactured homes. But condominiums are commonly overlooked by VA home buyers.

Condominiums are ideal starter homes. Their price point is often lower than that of single-family homes. And, condos are often the only affordable option in many cities.

The VA maintains a list of approved condominium communities. Veterans can search by city, state, or even condominium name on VA’s condo search tool. It’s not a short list.

As a Veteran or Service-member, consider the array of home types when shopping for a home.

VA Guaranteed Loan What Is a VA Guaranteed Loan?

VA Guaranteed Loan What Is a VA Guaranteed Loan?

A VA-guaranteed loan can be used to:

• Buy a home as a primary residence (This can be either existing or new construction.)

• Refinance an existing loan Benefits of a VA Guaranteed Loan

• No down payment, unless: o It is required by the lender

• The purchase price is more than the reasonable value of the property

• No mortgage insurance

• Reusable

One-time VA funding fee (can be included in the loan) o If you receive VA disability compensation, you are exempt from the VA funding fee

• Minimum property requirements o Ensure the property is safe, sanitary and sound

• VA staff assistance if you become delinquent on your loan

• Can be assumed by qualified persons

• Equal opportunity for all qualified Veterans Who Is Eligible? In general, the following people are eligible:

• Veterans who meet service length requirements

• Service members on active duty who have served a minimum period

• Certain Reservists and National Guard members

• Certain surviving spouses of deceased Veterans Apply at va.gov to determine your eligibility or call 877-827-3702 for more information. Key Underwriting Criteria

• There is no maximum debt ratio. However, the lender must provide compensating factors if the total debt ratio is more than 41 percent.

• There is no maximum loan amount.

• VA’s residual income guidelines ensure Veteran borrowers can afford the loan and determine how much money a Veteran must have left over after all debts and living expenses are considered.

• There is no minimum credit score requirement. Instead, VA requires a lender to review the entire loan profile.

For more information, see the complete VA credit guidelines at www.benefits.va.gov/warms/pam26_7.asp.

How Can You Start the Process?

VA provides policy, guidelines and oversight of the program. Lenders provide financing for eligible Veterans.

The guaranty allows Veterans to obtain a without down payments or mortgage insurance premiums.

Veterans need to obtain a Certificate of Eligibility (COE) to prove entitlement. You can obtain the COE online through va.gov.

Lenders also have the ability to request the COE on your behalf. April 20 20 Updated 2You should talk to several lenders to find the one that fits your needs.

They should know the VA loan program.

They should also offer competitive rates and terms. Note: The VA appraisal is not intended to be an “inspection” of the property.

Before committing to a purchase agreement, you should get expert advice.

Talk to a qualified residential inspection service.

You should also have radon testing performed.

Can VA Help If You’re Having Trouble Making Payments?

VA loan technicians may be able to help you retain your home and avoid foreclosure. Call 877-827-3702 to speak to a VA loan technician.

For more information, visit www.benefits.va.gov/homeloans/resources_payments.asp.

Uses for VA Home Loans?

VA Loans are intended to be used for the financing of a primary residences ONLY.

Occupancy by the spouse or dependent child satisfies the occupancy requirement if the

applicant is on active duty and not able to personally occupy the property.

Eligible Loan Purposes

• Purchase an existing or new construction single family detached home

• Purchase an existing or new construction condominium in a VA approved project

• Purchase an existing or new construction multi unit property (up to 4 units) ONLY if the applicant will be

occupying one of the properties

• Refinance an existing VA loan to lower the interest rate

• Refinance an existing mortgage or other debt secured by the property. The applicant must be occupying

the property.

• Cash out refinance to access the equity in a home occupied by the applicant.

In order to verify your credit history, your lender will obtain a credit report containing

information as reported by all 3 of the major credit bureaus: Trans Union, Equifax and

Experian.

Most people will have 3 credit scores but it is possible that you may have only 1 or

two scores if you have limited credit history.

This report will also include information on any public records such as bankruptcies,

judgments and tax liens.

Credit Scores

Credit Report

Though VA does not have a set minimum credit score requirements, lenders will have a minimum credit

score requirement.

General Credit Score Requirements

In addition to the credit scores, your actual credit history is also analyzed.

Collection account may need to be paid off in order to close your loan

It is preferable that the most recent 12 months show satisfactory payments and no other derogatory

information.

Credit History

If you experienced a major derogatory credit event, there will be waiting periods that will have to be

observed before you can be eligible to qualify for a loan.

Bankruptcy

Chapter 7

2 years from

discharge date

5 years from

discharge date

Bankruptcy

Chapter 13

Immediately after

discharge or

After 12 months of

payments***

5 years from

discharge date

Foreclosure*

2 years from

completion date

5 years from

completion date

Short Sale*

2 years from

completion date

5 years from

completion date

* If the foreclosure or short sale was on a VA loan, you may not have full entitlement available for the new loan

*** Must obtain written permission from the bankruptcy court/trustee and provide proof of satisfactory payment history

These

Income and Employment

Minimum History of Employment

A minimum of 2 year history in the same industry/line of work is required in most

instances but it’s not a universal rule.

Recent graduates can satisfy the two year requirement by providing proof of

schooling with a degree for the line of work you are now

employed in.

Active duty members do not need a two year history as

long as the minimum service requirement for eligibility

has been met.

Self employed borrowers must always have a two year history of self

employment and must show a two year history of filed tax returns to meet the

24 month requirement.

Income Calculations

If you are salaried, your base income will be used to qualify you for the loan.

However, if you are an hourly employee with varied hours, more than likely, your income will be averaged

over an extended period such as 18 or 24 months depending on the situation.

Overtime, bonuses, commission and part time employment must have a 24 history in order to be included

in the qualifying income. The income will be averaged out over 24 months. Verification of likelihood to

continue will also be required.

Non taxable income can be grossed up to account for the non-taxable status.

Debt to Income Ratios

A debt to income ratios is the percentage of your total debt obligation, including the new estimated

mortgage payment, all debts shown on your credit report, as well as alimony, child support etc, as

compared to your gross qualifying income.

EXAMPLE

The rule of thumb is that your debt to income ratio should not exceed 50% of the usable, gross monthly

income. However, higher percentages can be approved.

In addition to the debt to income ratio requirements, VA also has residual income requirements. VA residual

income looks at how much income is available after all monthly liabilities, including tax withholdings,

utilities and child care, are accounted for.

Residual Income By Region

For loan amounts of $80,000 and above

Family

Size

Northeast Midwest South West

1 $450 $441 $441 $491

2 $755 $738 $738 $823

3 $909 $889 $889 $990

4 $1025 $1033 $1033 $1117

5 $1062 $1039 $1039 $1158

over 5 Add $80 for each additional member up to a family of

seven

2400/5000= 48%

Deferred student loans

If student loan repayments are scheduled to

begin within 12 months of the date of loan

closing, the anticipated monthly payment will

be included.

If you are able to provide evidence that the

loan(s) will be deferred for a period outside

that time frame, the payment will not be

included.

Qualifying income: $5000

New mortgage payment: $2000

All other obligations: $400

Monthly debt payments

The payments shown on

your credit report will be

used to qualify you. If the

payments are incorrect,

you will be asked to

provide proof of the correct

payment.

Co-signed loans

If you co-signed for someone on a loan and

that loan is showing on your credit report, the

payment will be included in the ratios unless

you are able to provide evidence that the other

person on that loan has been making the

monthly payments from an account that you

are NOT a co-owner on.

Alimony/child support

You will be expected to

truthfully declare that

you pay alimony or child

support. You will be asked

to provide your divorce

decree and/or child support

order to verify the amounts.

Non-purchasing spouse

You should be aware that if you purchasing a home

in a community property state such as California

and are married, your spouse’s credit report will be

required. His/her debts will be included in the ratio

calculations even if he/she is not going to be on the

purchase or loan.

Documentation Checklist

The following is a general list of documentation required for a home loan application.

Not all items will apply to your situation

F DD214 if not active duty or Statement of service if active duty

EMPLOYMENT/INCOME

F Pay stubs (LES) for the most recent 30 days available

F W-2's for the previous two years

F Federal tax returns for the previous two years. All pages and schedules must be included

F If self-employed, provide all pages and schedules of last two years’ business tax returns and

corporate K-1's

F Award letter for Social Security benefits, disability or Pension

F Proof of receipt of child support, alimony or any other non-employment source of income

ASSETS

F Provide ALL pages of most recent 2 months’ statements for all accounts; including all checking, savings,

stocks, IRA, 401k, etc. The statements must show your name, account number and the name of the

banking institution. Any non-payroll deposits will have to be explained and documented.

F If funds to close will come from a gift, complete the gift letter (will be provided to you) and the following:

F From the donor - bank statements showing the funds in the donor's account and a copy of the check

from the donor's account

F From you - a copy of the deposit slip showing the gift check deposited into your account

F If funds to close are from sale of home

F Estimated closing statement showing anticipated proceeds

F Copy of final closing statement and deposit slip showing proceeds deposited into bank account

PROPERTY

F Select your insurance agent and provide agent's name, address, and phone number

F If refinance, or if you will be retaining your current home or own other property

F Current mortgage statement

F Copy of insurance declaration page

F If you’re currently renting, provide your Landlord’s name, phone number and address.

F 12 months canceled rent checks will be necessary

100% Financing Zero Down Payment Kentucky Mortgage Home Loans for Kentucky First time Home Buyers: Kentucky VA Home Loan Guidelines

.

Kentucky VA Home Loan Guidelines

Minimum History of Employment

A minimum of 2 year history in the same industry/line of work is required in most

instances but it’s not a universal rule.

Recent graduates can satisfy the two year requirement by providing proof of

schooling with a degree for the line of work you are now

employed in.

Active duty members do not need a two year history as

long as the minimum service requirement for eligibility

has been met.

Self employed borrowers must always have a two year history of self

employment and must show a two year history of filed tax returns to meet the

24 month requirement.

Income Calculations

If you are salaried, your base income will be used to qualify you for the loan.

However, if you are an hourly employee with varied hours, more than likely, your income will be averaged

over an extended period such as 18 or 24 months depending on the situation.

Overtime, bonuses, commission and part time employment must have a 24 history in order to be included

in the qualifying income. The income will be averaged out over 24 months. Verification of likelihood to

continue will also be required.

Non taxable income can be grossed up to account for the non-taxable status.

Retirement, Disability, alimony and child support income does not require a 2

year history but verification that it will continue for at least 3 years is required in

order for it to be included.

ASSETS

No down payment does not mean no cash needed

As mentioned in the closing cost section, there are fees that will need to be paid as part of your home

purchase or refinance.

You must have sufficient funds to cover any closing costs or fees not paid by the

seller or lender credit.

VA does not require additional cash to cover a certain number or mortgage

payments or unplanned expenses (cash reserves), however, your ability to

accumulate liquid assets and the amount of assets currently available is taken into

consideration in the overall credit worthiness analysis.

Allowable source of funds

Funds for your down payment, closing costs and other expenses can come from:

• Checking/savings accounts

• Investment accounts

• Retirement account

Gift funds from a relative are an allowed source of funds to cover down payment and or closing costs.

The gift will need to be verified and paper trailed via bank statements and a gift letter will need to be signed

by your and the gift donor .

Funds from unsecured loans (signature loans, credit card advances) or funds that can not be documented

are not acceptable source of funds.

Federal regulations require that all deposits into your account be documented.

In the instance of payroll deposits, nothing will need to be done if the deposit shows as a Direct Deposit

from your employer.

All other deposits will need to be explained and documented.

Debt to Income Ratios

A debt to income ratios is the percentage of your total debt obligation, including the new estimated

mortgage payment, all debts shown on your credit report, as well as alimony, child support etc, as

compared to your gross qualifying income.

EXAMPLE

The rule of thumb is that your debt to income ratio should not exceed 50% of the usable, gross monthly

income. However, higher percentages can be approved.

In addition to the debt to income ratio requirements, VA also has residual income requirements. VA residual

income looks at how much income is available after all monthly liabilities, including tax withholdings,

utilities and child care, are accounted for.

Residual Income By Region

For loan amounts of $80,000 and above

Family

Size

Northeast Midwest South West

1 $450 $441 $441 $491

2 $755 $738 $738 $823

3 $909 $889 $889 $990

4 $1025 $1033 $1033 $1117

5 $1062 $1039 $1039 $1158

over 5 Add $80 for each additional member up to a family of

seven

2400/5000= 48%

Deferred student loans

If student loan repayments are scheduled to

begin within 12 months of the date of loan

closing, the anticipated monthly payment will

be included.

If you are able to provide evidence that the

loan(s) will be deferred for a period outside

that time frame, the payment will not be

included.

Qualifying income: $5000

New mortgage payment: $2000

All other obligations: $400

Monthly debt payments

The payments shown on

your credit report will be

used to qualify you. If the

payments are incorrect,

you will be asked to

provide proof of the correct

payment.

Co-signed loans

If you co-signed for someone on a loan and

that loan is showing on your credit report, the

payment will be included in the ratios unless

you are able to provide evidence that the other

person on that loan has been making the

monthly payments from an account that you

are NOT a co-owner on.

Alimony/child support

You will be expected to

truthfully declare that

you pay alimony or child

support. You will be asked

to provide your divorce

decree and/or child support

order to verify the amounts.

Non-purchasing spouse

You should be aware that if you purchasing a home

in a community property state such as California

and are married, your spouse’s credit report will be

required. His/her debts will be included in the ratio

calculations even if he/she is not going to be on the

purchase or loan.

Documentation Checklist

The following is a general list of documentation required for a home loan application.

Not all items will apply to your situation

CREDIT / IDENTIFICATION/ ELIGIBILITY

F Copy of driver’s license or other photo I.D.

F Copy of divorce decree

F Copy of bankruptcy papers, including all schedules and discharge, and credit explanation letter for

reason for bankruptcy.

F Letter of explanation on any late payments, collections, charge off’s or derogatory credit

F Letter of explanation for all recent credit inquiries

F DD214 if not active duty or Statement of service if active duty

EMPLOYMENT/INCOME

F Pay stubs (LES) for the most recent 30 days available

F W-2's for the previous two years

F Federal tax returns for the previous two years. All pages and schedules must be included

F If self-employed, provide all pages and schedules of last two years’ business tax returns and

corporate K-1's

F Award letter for Social Security benefits, disability or Pension

F Proof of receipt of child support, alimony or any other non-employment source of income

ASSETS

F Provide ALL pages of most recent 2 months’ statements for all accounts; including all checking, savings,

stocks, IRA, 401k, etc. The statements must show your name, account number and the name of the

banking institution. Any non-payroll deposits will have to be explained and documented.

F If funds to close will come from a gift, complete the gift letter (will be provided to you) and the following:

F From the donor - bank statements showing the funds in the donor's account and a copy of the check

from the donor's account

F From you - a copy of the deposit slip showing the gift check deposited into your account

F If funds to close are from sale of home

F Estimated closing statement showing anticipated proceeds

F Copy of final closing statement and deposit slip showing proceeds deposited into bank account

PROPERTY

F Select your insurance agent and provide agent's name, address, and phone number

F If refinance, or if you will be retaining your current home or own other property

F Current mortgage statement

F Copy of insurance declaration page

F If you’re currently renting, provide your Landlord’s name, phone number and address.

F 12 months canceled rent checks will be necessary for private landlords. If you live with a family member,

letter stating you live rent-free will be required

Subscribe to:

Comments (Atom)