Kentucky VA Home Loans offered by a Kentucky Veteran. I have successfully originated over 100 VA Kentucky Mortgages for fellow Kentucky Veterans and active duty personnel.$0 Down Home loans in KY. Free Credit Report and free pre-approvals. I can be reached by text or call at 502-905-3708, or kentuckyloan@gmail.com Not affiliated with VA Government Agency. NMLS #57916 Company NMLS #1738461 Former Army Tanker 19k

Pages

- How to Apply for a Kentucky VA Loan

- Accessibility Statement

- KENTUCKY AND LOUISVILLE VA APPROVED CONDOS

- Things needed for a Kentucky VA Mortgage Loan Approval

- Customer Reviews/Testimonials

- Kentucky VA Home Loan Mortgage New Construction

- Refinancing Louisville Ky VA Loans

- Home

- Privacy And Disclosures

- Mortgage Application Process

- Certificate of Eligibility

- Kentucky VA Loan Requirements

- VA home loan

Louisville Kentucky Mortgage Lender VA Home Loans

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgages: KENTUCKY VA MORTGAGE LOAN INFORMATION

COMMON KENTUCKY VA LOAN MYTHS FOR KENTUCKY VETERANS

- VA loans are difficult to qualify for.

- All VA loans require a down payment.

- VA loans require private mortgage insurance (PMI).

- You can't refinance a VA loan.

- You can only have one VA loan.

- You can use a VA loan once.

- VA loans are not assumable.

- You can't buy land with a VA loan.

- You can't build a house with a VA loan.

- VA loans only apply to the home purchase itself.

Is it hard to qualify for a VA loan?

Myth #1: Kentucky VA loans are difficult to qualify for.

Fact: VA loans have fewer credit restrictions compared to conventional loans. These reduced restrictions, like a higher debt-to-income (DTI) ratio and more leniency regarding credit scores, mean it can be easier to qualify. VA has no minimum credit score but lenders will have overlays with most being 620 and some going down to 580, with a few going all the way down to 500 but it is very difficult to get approved at this level --- though each individual case and lender will vary.

Do VA loans require a down payment?

Myth #2: All Kentucky VA loans require a down payment.

Fact: While conventional loans generally require down payment options that can reach up to 20%, no such thing is required with a VA home loan at or under the local conforming limit. Down payments are still an option, of course, but they are not a requirement.

The VA allows you to purchase jumbo loans, but the down payment depends on your entitlement:

- Full entitlement - 100% LTV (loan-to-value) maximum

- Partial entitlement - Maximum loan must be calculated using 25% guarantee of 1 unit county loan limit. Max LTV is lesser of max allowed or LTV required to meet 25% guaranty

Do VA loans have PMI?

Myth #3: VA loans require private mortgage insurance (PMI).

Fact: Private mortgage insurance is not required for VA loans. PMI typically adds 0.2%-0.9% of expenses to your monthly mortgage payments when you put less than 20% down. That’s a big additional expense you don’t have to worry about when you get a VA loan. Remember, VA loans do come with a funding fee.

Can you refinance a VA loan?

Myth #4: You can’t refinance a Kentucky VA loan.

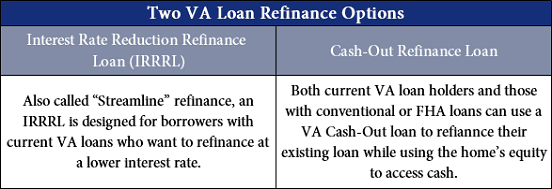

Fact: Thanks to VA streamline and cash-out loan programs, VA loans are actually easier to refinance than conventional mortgages. The streamline version lowers the mortgage rate of an already existing VA loan, usually for less than the current principal and interest. This means it doesn't require a credit check or appraisal. The cash-out option involves a credit check and appraisal, since the home’s value represents the maximum loan amount and the new loan will be larger than the existing loan.

How many VA loans can you have?

Myth #5: You can only have one Kentucky VA loan.

Fact: There is no limit to the number of VA loans you can have. While it is possible to have multiple VA loans at once, this depends on VA loan entitlement. VA loan entitlement refers to the amount that the VA will pay your lender if you default on your loan. There is a limit on your VA entitlement. It can be split across multiple loans but the limit remains the same. For full entitlement, the VA covers:

- Up to $36,000 for loans < $144,000

- Up to 25% for loans > $144,000

If, however, you’ve used a portion of your entitlement in one loan that you’re still actively paying off (or defaulted on), the amount of entitlement you have on any new loan is reduced. This means that you may need to put money down yourself instead of having the usual benefit of a zero down payment for VA loans. To learn about VA loan limits and entitlement, visit us here.

How many times can you use a VA loan?

Myth #6: You can only use a Kentucky VA loan once.

Fact: There is no limit on the number of times you can use the VA loan benefit. You can use the benefit an unlimited number of times throughout your life, as long as you still qualify. To qualify, you need to meet certain requirements, which you’ll already be aware of if you’ve taken out a VA loan in the past. For those who haven’t taken out a VA loan prior, you can learn how to qualify here.

Are VA loans assumable?

Myth #7: Kentucky VA loans are not assumable.

Fact: Federally insured and guaranteed loans are usually assumable. This includes VA loans. What does it mean if a loan is assumable? An assumable mortgage is when the lender allows you, the buyer, to take over the current mortgage that the seller has. This can save a lot of money if the interest rates are lower on the existing mortgage than they would be to take out a new mortgage. Assumable mortgages allow buyers, who otherwise wouldn’t qualify for a VA loan, to take over a VA mortgage. This means that you would get most, if not all, of the benefits that come with VA loan eligibility. In order to assume a VA mortgage, you will need to meet certain requirements, such as:

- acceptable credit history and credit score

- debt-to-income ratio to meet guidelines

- No Bankruptcies or foreclosures in last 2 years ( Chapter 7) --Chapter 13 is possible within one year in the plan.

- acceptable work history for last two years

- residual income requirements

- property passing VA standards

You will also be required to pay the VA funding fee that comes with VA loans. This equates to 0.5% of the total loan amount. This may be waived if you’re an eligible military borrower who qualifies for an exemption. Other fees may be required as well.

For sellers, if a non-military borrower assumes your mortgage, your VA entitlement won’t be restored until the loan is paid in full. You will want to request that the lender releases you from liability on the loan to avoid dips in your credit reports if the buyer defaults or makes a late payment.

Can you buy land with a VA loan?

Myth #8: You can’t buy land with a Kentucky VA loan.

Fact: The VA doesn’t authorize buyers to singularly purchase land with a VA loan. However, you can purchase land and build a home on it. This is partially because VA loans are granted with a required occupancy period — you must use the property as your primary residence for at least one year. If there is already a home on the land, this is acceptable. Another acceptable scenario is if you plan to immediately build a home on the land after purchase. This may require a purchase/construction loan.

You can also purchase land with a conventional loan or certain other types of loans. Then you can build a home on the land using a VA construction loan. Upon completion, military borrowers can refinance VA construction loans into permanent VA loans. Builders must be VA-approved.

Finally, you can purchase land and build a property using a non-VA purchase/construction loan. Then you can refinance the loan upon completion of the build into a permanent VA loan (as long as the property meets the VA’s requirements).

Can you use a VA loan to build a house?

Myth #9: You can’t build a house with a Kentucky VA loan.

Fact: VA construction loans do exist, as mentioned above, and under the right circumstances, they can be refinanced into permanent VA loans. Ask your lender about VA purchase/construction loan options.

Can you use a VA loan for home improvement?

Myth #10: Kentucky VA loans only apply to the home purchase itself.

Fact: The VA allows for increases to purchase loans for the purpose of making renovations. The VA’s Energy Efficiency Mortgage program, for instance, lets borrowers add up to $6,000 to their home loan amount to install solar heating, insulation and storm windows, among other features.

In conclusion

Applicant subject to credit and underwriting approval. Not all applicants will be approved for financing. Receipt of application does not represent an approval for financing or interest rate guarantee does not guarantee the quality, accuracy, completeness or timelines of the information in this publication. While efforts are made to verify the information provided, the information should not be assumed to be error free.

Mortgage Loan Officer

email: kentuckyloan@gmail.com

Kentucky VA Home Pest Termites Inspection Fees and Repairs cost for Veterans

Veterans Benefits Administration Circular 26-22-11

Department of Veterans Affairs June 15, 2022 Washington, D.C. 20420

Pest Inspection Fees and Repair Costs

1. Purpose. This Circular addresses the Department of Veterans Affairs policies regarding wood destroying pest inspection fees and repair costs.

2. Background. Historically, VA has authorized, as a local variance, that Veterans may be charged for a wood destroying pest inspection report in a limited number of states and territories.1 Localities susceptible to termites and other wood destroying pests, however, are on the rise. Accordingly, VA requires, as a Minimum Property Requirement, a wood destroying pest inspection report for certain properties located in an area on the Termite Infestation Probability Map2 where the probability of termite infestation is “very heavy” or “moderate to heavy.”3 If applicable, the VA Notice of Value (NOV) will be conditioned for this requirement and MPR repairs identified on a wood destroying pest inspection report must be completed prior to guaranty.4

3. Action. Effective immediately, VA is authorizing in advance, as a local variance, that Veterans may be charged wood destroying pest inspection fees, where required by the NOV. Veterans may also pay for any repairs required to ensure compliance with MPRs. Veterans are encouraged to negotiate the cost of the wood destroying pest inspection and repairs with the seller.

a. Documentation for Audit Purposes. An itemized invoice identifying the Veteran and the property is required to verify the cost on the Closing Disclosure Statement (CD). Lenders should include the invoice(s) to support the cost of the inspection and any repairs in the loan file if the loan is selected for Full File Loan Review (FFLR).

4. Paperwork Reduction Act. The information collection requirements contained in this document have been approved by the Office of Management and Budget (OMB) under the Paperwork Reduction Act of 1995 (44 U.S.C. § 3501-3520) and assigned OMB control number 2900-0515. In accordance with the Paperwork Reduction Act, VA may not conduct or sponsor, and a person is not required to respond to, a collection of information unless the collection displays a currently valid OMB control number

1 38 C.F.R. § 36.4313(d)(1)(ix).

2 https://basc.pnnl.gov/images/termite-infestation-probability-map-adapted-2021-international-residential-code-irc-figure.

3 VA Lenders Handbook, Chapter 13, Topic 8.c.

4 38 U.S.C. § 3704(a), 38 C.F.R. § 36.4351.

Mortgage Loan Officer

email: kentuckyloan@gmail.com

Kentucky VA Mortgage Guidelines For Approval

Kentucky Mortgage VA Underwriting

- Rental income from boarders can now be used as qualifying income provided

- A 2 year history of tax returns can be provided showing boarder income generated by the property; AND

- The use of the property for boarder rental cannot impair the residential nature of the property and cannot exceed 25% of the property's total floor area

- Alimony, child support, and maintenance require at least 3 years continuance to be considered effective income.

- For payment plans after a judgment, VA will generally require 12 months of timely payments before credit is considered reestablished. A shorter repayment history may be considered if it can be determined that the borrower addressed the judgment responsibly and began a repayment plan immediately after it was filed. If borrower has missed payments within the last 12 months, they will be ineligible for financing even if the debt is paid in full.

- For voluntary short sales or deeds-in-lieu where the borrower was current on their payments at the time the property was surrendered, no minimum derogatory credit waiting period will be required.

- VA's list of required Appraisal Report Contents has been updated and now includes specific photographs required on the appraisal (refer to VA Chapter 11: Topic 3: Appraisal Report Contents for full list).

- VA Chapter 11: Topic 4: Gross Living Area has been added to provide direction in determining the Gross Living Area of the property.

- Other sections have been updated to include guideline changes from previous VA Circulars.

KENTUCKY VA MORTGAGE QUALIFYING GUIDELINES

Mortgage Loan Officer

email: kentuckyloan@gmail.com

Louisville Kentucky Mortgage Lender VA, can you have 2 Kentucky VA Loans?

Kentucky VA Mortgage Refinance

Kentucky VA Mortgage Refinance Guidelines |

|

What are the eligibility requirements for a VA Loan in Kentucky?

What are VA Home Loans?

VA Loans provide military veterans and current service members a distinct advantage when it comes time to purchase or refinance a home. Today’s VA Loans have the most favorable terms available for most veterans. VA Loans can be used to purchase a new home with no down payment with no mortgage insurance or refinance up to 90% of a homes current equity.

What are the eligibility requirements for a VA Loan in Kentucky?

Veterans Affairs loan guidelines use two methods of income qualification in Kentucky. The residual income method is the primary method, where it is determined that the borrower has sufficient income to cover daily living costs once housing, taxes, insurance and all other liabilities like credit card and auto payments have been made. Additionally, VA loans use a debt to income ratio (DTI). Using this ratio, the veteran’s total debt should not exceed 41% of the veteran’s total income. Most lenders will require at least a 620 credit score for a VA Loan approval. VA does not have a minimum credit score requirement, but lenders do.How much can I borrow?

The maximum VA Mortgage amount is determined by:

Maximum Finance: For purchase transactions, the Maximum VA Loan will be 100% of the lower of the selling price or the appraised value

What property types are allowed for VA Loans in Kentucky

VA Loans may be used to purchase or refinance single family residences and VA approved condo projects if the property is the veteran’s primary residence.

Can I do a VA refinance in Kentucky?

Three kinds of VA Refinance programs are available for veterans in Kentucky.

Rate/Term VA Refinance

The Rate/Term VA Refinance can be used to refinance a conventional, FHA or subprime mortgage into a stable, fixed rate VA Loan.VA Cash-Out Refinance

A Cash-Out VA Refinance is very beneficial for the veteran who wants to access the equity that they have built up in their home. VA Loans can be used to refinance up to 90% of a homes current value and take cash out for any reason.

Streamline Refinance

The VA Streamline Refinance is designed to lower the interest rate on a current VA mortgage or convert a current VA adjustable rate mortgage into a fixed rate. A VA Streamline Refinance Loan can be performed quickly and easily. It requires much less hassle and paperwork than a normal refinance including no appraisal, no qualifying debt ratios and no income verification.What factors determine if I am eligible for a VA Refinance Loan?

VA refinance loans use two methods for income qualification purposes in Kentucky. The residual income method is the primary method, where it is determined that the borrower has sufficient income to cover daily living costs once housing, taxes, insurance and all other liabilities like credit card and auto payments have been made. Additionally, VA loans use a debt to income ratio (DTI). Using this ratio, the veteran’s total debt should not exceed 41% of the veteran’s total income. Most lenders will require at least a 620 credit score for a VA Loan approval even though VA states in their guidelines it has no minimum credit score.Why choose a VA Home Loan?

Kentucky VA Mortgages require no down payment.

There are no prepayment penalties for VA Home Loans.

An Kentucky VA Loan is fully assumable, provided the person assuming is qualified.

VA Mortgage Loans have no PMI premiums.

A VA Mortgage Loan is eligible for non-credit qualifying, Streamline Refinance or “IRRRL”.

A VA Home Mortgage is available all areas of the country, provided a market exists for the property and the home meets VA’s property standards.

A VA Home Loan may be used to purchase or refinance a new or existing home.

Kentucky VA Loans are offered at terms of 15 or 30 years.

VA Guaranteed Loan What Is a VA Guaranteed Loan?

VA Guaranteed Loan What Is a VA Guaranteed Loan?