Kentucky VA Home Loans offered by a Kentucky Veteran. I have successfully originated over 100 VA Kentucky Mortgages for fellow Kentucky Veterans and active duty personnel.$0 Down Home loans in KY. Free Credit Report and free pre-approvals. I can be reached by text or call at 502-905-3708, or kentuckyloan@gmail.com Not affiliated with VA Government Agency. NMLS #57916 Company NMLS #1738461 Former Army Tanker 19k

Pages

- How to Apply for a Kentucky VA Loan

- Accessibility Statement

- KENTUCKY AND LOUISVILLE VA APPROVED CONDOS

- Things needed for a Kentucky VA Mortgage Loan Approval

- Customer Reviews/Testimonials

- Kentucky VA Home Loan Mortgage New Construction

- Refinancing Louisville Ky VA Loans

- Home

- Privacy And Disclosures

- Mortgage Application Process

- Certificate of Eligibility

- Kentucky VA Loan Requirements

- VA home loan

Louisville Kentucky Mortgage Lender VA, can you have 2 Kentucky VA Loans?

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgage: Can you have 2 Kentucky VA Loans?: Did You Know A Kentucky Veteran Can Have Multiple VA Loans: That’s right. VA will allow a Kentucky Veteran to have multiple Kentucky ...

Kentucky VA Mortgage Refinance

Kentucky VA Mortgage Refinance Guidelines |

|

Kentucky VA Mortgage Guidelines for Student Loan Payments

Clarification and New Policy for Student Loan Debts and Obligations

1. Purpose. The purpose of this Circular is to clarify and explain new policy regarding

student loans for the underwriting of Department of Veterans Affairs (VA) guaranteed home

loans.

2. Background. The policy in the Lender’s Handbook- VA Pamphlet 26-7, chapter 4, section 5,

paragraph G will now be titled Student Loans. The clarification will apply to deferred student

loans and the new policy will provide guidance for student loans in repayment or, to begin

repayment within 12 months of a VA loan closing. Student loans under certain repayment plan

types are described at studentaid.ed.gov. This policy applies to all student loan repayment types.

3. How to Calculate a Student Loan Monthly Payment.

a. If the Veteran or other borrower provides written evidence that the student loan debt will be

deferred at least 12 months beyond the date of closing, a monthly payment does not need to be

considered.

b. If a student loan is in repayment or scheduled to begin within 12 months from the date of

VA loan closing, the lender must consider the anticipated monthly obligation in the loan

analysis and utilize the payment established in paragraph (1) or (2) below. Calculate each loan

at a rate of 5 percent of the outstanding balance divided by 12 months (example: $25,000

student loan balance x 5% = $1,250 divided by 12 months = $104.17 per month is the monthly

payment for debt ratio purposes).

(1) The lender must use the payment(s) reported on the credit report for each student loan(s) if

the reported payment is greater than the threshold payment calculation above.

(2) If the payment reported on the credit report is less than the threshold payment calculation

above, the loan file must contain a statement from the student loan servicer that reflects the

actual loan terms and payment information for each student loan(s). The statement(s) must be

dated within 60 days of VA loan closing and maybe an electronic copy from the student loan

servicer’s website or a printed statement provided by the student loan servicer. It is the

lender’s discretion as to whether the credit report should be supplemented with this information

Text/call 502-905-3708

kentuckyloan@gmail.com

1. Purpose. The purpose of this Circular is to clarify and explain new policy regarding

student loans for the underwriting of Department of Veterans Affairs (VA) guaranteed home

loans.

2. Background. The policy in the Lender’s Handbook- VA Pamphlet 26-7, chapter 4, section 5,

paragraph G will now be titled Student Loans. The clarification will apply to deferred student

loans and the new policy will provide guidance for student loans in repayment or, to begin

repayment within 12 months of a VA loan closing. Student loans under certain repayment plan

types are described at studentaid.ed.gov. This policy applies to all student loan repayment types.

3. How to Calculate a Student Loan Monthly Payment.

a. If the Veteran or other borrower provides written evidence that the student loan debt will be

deferred at least 12 months beyond the date of closing, a monthly payment does not need to be

considered.

b. If a student loan is in repayment or scheduled to begin within 12 months from the date of

VA loan closing, the lender must consider the anticipated monthly obligation in the loan

analysis and utilize the payment established in paragraph (1) or (2) below. Calculate each loan

at a rate of 5 percent of the outstanding balance divided by 12 months (example: $25,000

student loan balance x 5% = $1,250 divided by 12 months = $104.17 per month is the monthly

payment for debt ratio purposes).

(1) The lender must use the payment(s) reported on the credit report for each student loan(s) if

the reported payment is greater than the threshold payment calculation above.

(2) If the payment reported on the credit report is less than the threshold payment calculation

above, the loan file must contain a statement from the student loan servicer that reflects the

actual loan terms and payment information for each student loan(s). The statement(s) must be

dated within 60 days of VA loan closing and maybe an electronic copy from the student loan

servicer’s website or a printed statement provided by the student loan servicer. It is the

lender’s discretion as to whether the credit report should be supplemented with this information

Joel Lobb (NMLS#57916)

Senior Loan Officer

Senior Loan Officer

American Mortgage Solutions, Inc.

10602 Timberwood Circle Suite 3

Louisville, KY 40223

Company ID #1364 | MB73346

Text/call 502-905-3708

kentuckyloan@gmail.com

Disclaimer: No statement on this site is a commitment to make a loan. Loans are subject to borrower qualifications, including income, property evaluation, sufficient equity in the home to meet Loan-to-Value requirements, and final credit approval. Approvals are subject to underwriting guidelines, interest rates, and program guidelines and are subject to change without notice based on applicant's eligibility and market conditions. Refinancing an existing loan may result in total finance charges being higher over the life of a loan. Reduction in payments may reflect a longer loan term. Terms of any loan may be subject to payment of points and fees by the applicant Equal Opportunity Lender. NMLS#57916 http://www.nmlsconsumeraccess.org/

-- Some products and services may not be available in all states. Credit and collateral are subject to approval. Terms and conditions apply. This is not a commitment to lend. Programs, rates, terms and conditions are subject to change without notice. The content in this marketing advertisement has not been approved, reviewed, sponsored or endorsed by any department or government agency. Rates are subject to change and are subject to borrower(s) qualification.

VA Student Loans for Kentucky Mortgage Loan Approval

Kentucky VA Student Loans

Did you know that VA has a new policy for calculating student loan payments?

Considering the Payment:

- If the student loan repayments are to begin within 12 months of closing, the debt will be considered.

- If the student loan payment is being deferred for a period longer than 12 months after closing, the debt does not need to be considered.

Calculating the Payment:

- Calculate each loan at a rate of 5% of the outstanding balance then divide that by 12 months.

Example: $25,000 x 5% = $1,250 divided by 12 months is $104.17 per month.

- If the student loan payment reported on the Borrower’s credit report is greater than the calculated payment, then the credit report payment will be used.

- If the payment reported on the credit report is less than the calculated amount, the lender must require a statement (dated within 60 days of closing) from the student loan servicer that reflects the actual terms and payment information for each student loan.

- If the student loan payment is in an Income Based Repayment Plan and the current payment is documented to continue for at least 12 months after closing, the lender may use the IBR amount. If the payment is not expected to continue for at least 12 months after closing, a monthly statement is required. If a statement is not available, the calculation of 5% of the balance, divided by 12 will be used.

Documentation for payments and 12 months continuance will be required

For more Information see VA Circular 26.17.02 dated 1/23/17

What are the eligibility requirements for a VA Loan in Kentucky?

What are VA Home Loans?

VA Loans provide military veterans and current service members a distinct advantage when it comes time to purchase or refinance a home. Today’s VA Loans have the most favorable terms available for most veterans. VA Loans can be used to purchase a new home with no down payment with no mortgage insurance or refinance up to 90% of a homes current equity.

What are the eligibility requirements for a VA Loan in Kentucky?

Veterans Affairs loan guidelines use two methods of income qualification in Kentucky. The residual income method is the primary method, where it is determined that the borrower has sufficient income to cover daily living costs once housing, taxes, insurance and all other liabilities like credit card and auto payments have been made. Additionally, VA loans use a debt to income ratio (DTI). Using this ratio, the veteran’s total debt should not exceed 41% of the veteran’s total income. Most lenders will require at least a 620 credit score for a VA Loan approval. VA does not have a minimum credit score requirement, but lenders do.How much can I borrow?

The maximum VA Mortgage amount is determined by:

Maximum Finance: For purchase transactions, the Maximum VA Loan will be 100% of the lower of the selling price or the appraised value

What property types are allowed for VA Loans in Kentucky

VA Loans may be used to purchase or refinance single family residences and VA approved condo projects if the property is the veteran’s primary residence.

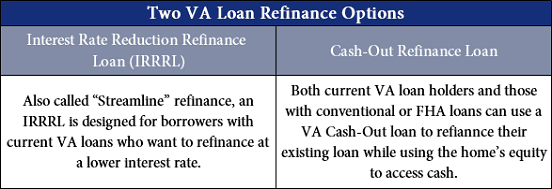

Can I do a VA refinance in Kentucky?

Three kinds of VA Refinance programs are available for veterans in Kentucky.

Rate/Term VA Refinance

The Rate/Term VA Refinance can be used to refinance a conventional, FHA or subprime mortgage into a stable, fixed rate VA Loan.VA Cash-Out Refinance

A Cash-Out VA Refinance is very beneficial for the veteran who wants to access the equity that they have built up in their home. VA Loans can be used to refinance up to 90% of a homes current value and take cash out for any reason.

Streamline Refinance

The VA Streamline Refinance is designed to lower the interest rate on a current VA mortgage or convert a current VA adjustable rate mortgage into a fixed rate. A VA Streamline Refinance Loan can be performed quickly and easily. It requires much less hassle and paperwork than a normal refinance including no appraisal, no qualifying debt ratios and no income verification.What factors determine if I am eligible for a VA Refinance Loan?

VA refinance loans use two methods for income qualification purposes in Kentucky. The residual income method is the primary method, where it is determined that the borrower has sufficient income to cover daily living costs once housing, taxes, insurance and all other liabilities like credit card and auto payments have been made. Additionally, VA loans use a debt to income ratio (DTI). Using this ratio, the veteran’s total debt should not exceed 41% of the veteran’s total income. Most lenders will require at least a 620 credit score for a VA Loan approval even though VA states in their guidelines it has no minimum credit score.Why choose a VA Home Loan?

Kentucky VA Mortgages require no down payment.

There are no prepayment penalties for VA Home Loans.

An Kentucky VA Loan is fully assumable, provided the person assuming is qualified.

VA Mortgage Loans have no PMI premiums.

A VA Mortgage Loan is eligible for non-credit qualifying, Streamline Refinance or “IRRRL”.

A VA Home Mortgage is available all areas of the country, provided a market exists for the property and the home meets VA’s property standards.

A VA Home Loan may be used to purchase or refinance a new or existing home.

Kentucky VA Loans are offered at terms of 15 or 30 years.

Kentucky VA Home Loan Approval Requirements with Collections on Credit Report

|

Kentucky VA Home Loans Credit Scores Requirements

- No down payment required for Kentucky VA Loans

- There are closing costs on all home purchases and refinances, however, on purchases, VA allows the home seller to give the home buyer up to a 4.0% sellers concession towards the home buyer’s closing costs. If the home buyer is short on closing costs or if the home seller is not willing to give a sellers concession, the Veteran can get a lender’s credit to cover part or all of the closing costs

- There is no monthly mortgage insurance premium on Kentucky VA Loans

- Here are VA Credit Requirements:

- VA does not have a mandatory minimum credit score requirement

- VA lets the lender to set the minimum credit score requirement. Most lenders will want a 620 credit score nowadays.

- VA does not have a maximum debt to income ratio requirement. If you loan pre-approval shows a refer eligible, the max debt to income ratios are usually limited to 41% for the new house payment and your current bills on the credit report of your gross income. For example, lets say you make $3000 a month, and you have $400 in monthly bills on the credit report. Then your max house payment would be $830.00

- 2 year waiting period to qualify for a VA mortgage loan after a Chapter 7 Bankruptcy, short sale, and recorded dates of foreclosure and/or deed in lieu of foreclosure

- If you have deferred student loans that are deferred for at least 12 or more months, it will be exempt from from debt to income ratio calculations

Related Articles Below:

Subscribe to:

Comments (Atom)