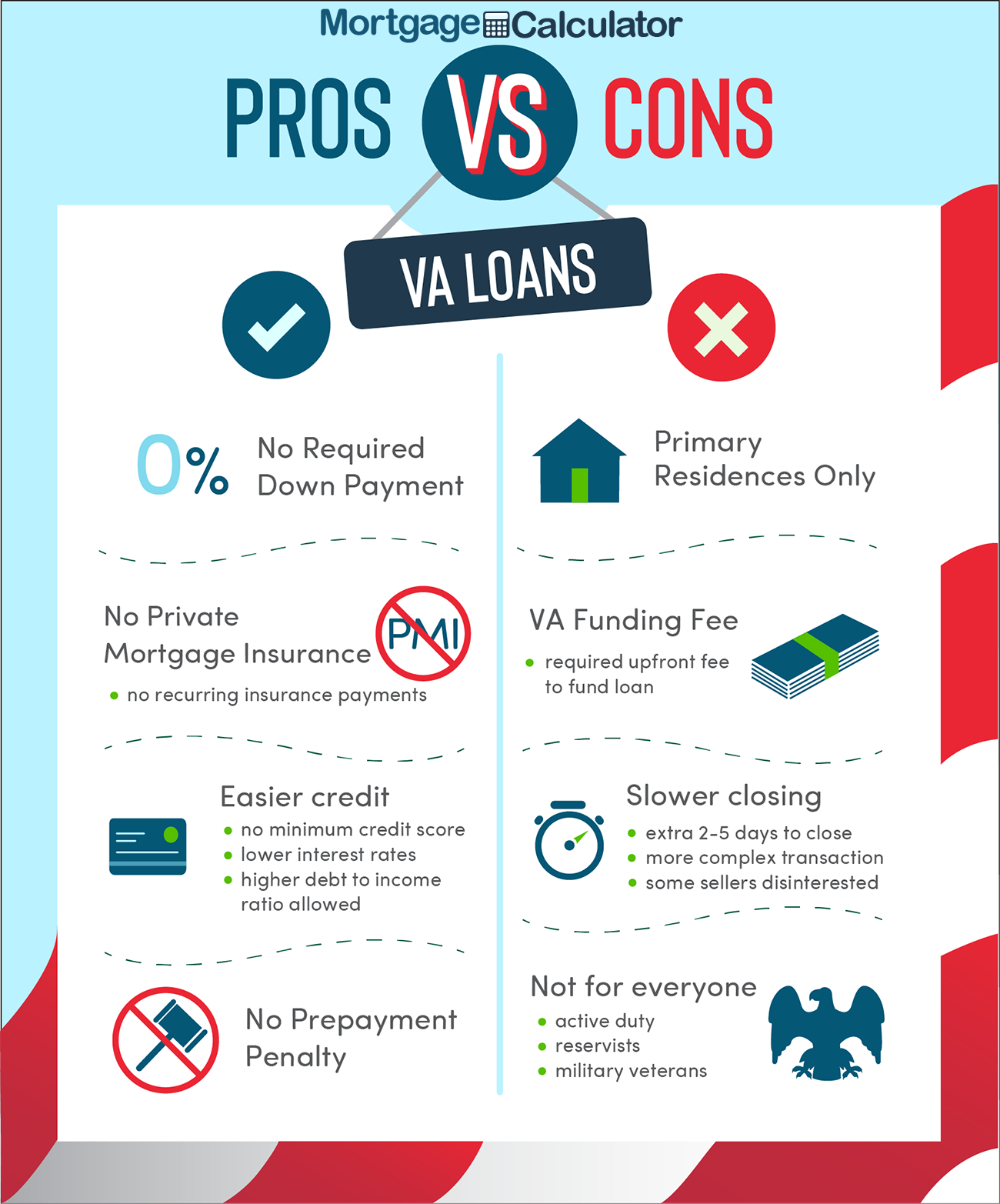

The Kentucky VA funding fee status is specified on the Certificate of Eligibility (COE). The standard funding fees as shown

below may be financed in the loan amount. The COE indicates the exempt status as follows:

• A Veteran receiving disability compensation (or would be eligible for disability, but is receiving

retirement pay or active service pay)

• A surviving spouse of any Veteran who died during active duty or from a service-connected disability.

The surviving spouse must be in receipt of the Dependency and Indemnity Compensation

• A Veteran who is rated as eligible to receive compensation from a pre-discharge disability examination

or review of existing medical evidence that results in the issuance of a memorandum rating before the

loan closes

If the COE does not reflect the exemption and the Veteran believes he/she is exempt, obtain the following:

• An updated COE within three days of closing using the ‘Correct’ function in WebLGY, or

• For an active duty service member who indicates they have a pre-discharge claim pending, the RLC must

be contacted by email to assist with obtaining a proposed or memorandum rating to determine if the

Service member may be exempt from paying the funding fee. If a proposed or memorandum rating is

not obtained prior to closing, the Service member will not be eligible for a funding fee exemption

Funding Fees

Type of Loan Down Payment First-time Use Subsequent Use

Purchase & Construction Loans