Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgage: Zero Down Kentucky Mortgages: ZERO DOWN HOME LOANS IN KENTUCKY There

There are a few programs that feature zero down payment in Kentucky For Home buyers: USDA and VA. USDA is typically for rural areas, and VA is for military veterans. Lastly Kentucky Housing with the Down Payment Assistance Program of $6,000 and the $5000 Welcome Home Grant

Kentucky VA Home Loans offered by a Kentucky Veteran. I have successfully originated over 100 VA Kentucky Mortgages for fellow Kentucky Veterans and active duty personnel.$0 Down Home loans in KY. Free Credit Report and free pre-approvals. I can be reached by text or call at 502-905-3708, or kentuckyloan@gmail.com Not affiliated with VA Government Agency. NMLS #57916 Company NMLS #1738461 Former Army Tanker 19k

Pages

- How to Apply for a Kentucky VA Loan

- Accessibility Statement

- KENTUCKY AND LOUISVILLE VA APPROVED CONDOS

- Things needed for a Kentucky VA Mortgage Loan Approval

- Customer Reviews/Testimonials

- Kentucky VA Home Loan Mortgage New Construction

- Refinancing Louisville Ky VA Loans

- Home

- Privacy And Disclosures

- Mortgage Application Process

- Certificate of Eligibility

- Kentucky VA Loan Requirements

- VA home loan

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgage: Credit Scores Kentucky Mortgage Loan

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgage: Credit Scores Kentucky Mortgage Loan: ∘ What kind of credit score do I need to qualify for different first time home buyer loans in Kentucky? Answer. Mos...

Kentucky USDA Rural Housing Mortgage Lender: Kentucky Rural Housing USDA Maximum Income by Coun...

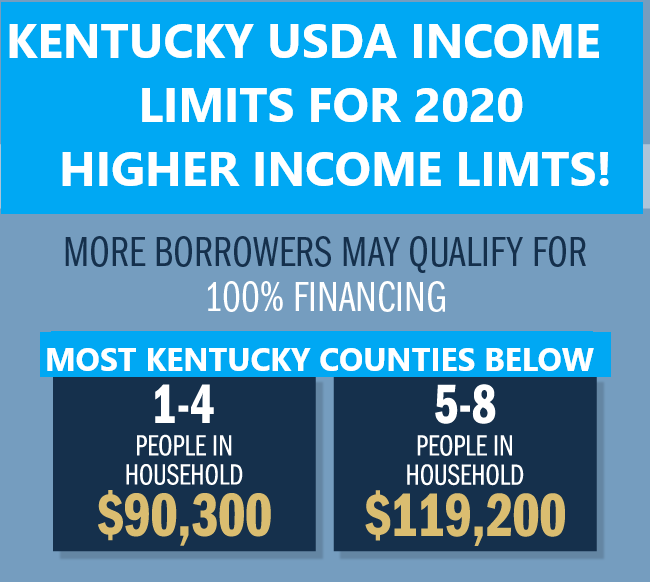

The base USDA income limits are for most Kentucky counties below:

New Income limits for most counties (*) in Kentucky are $90,300 for a household family of four and household families of five or more can make up to $119,200.

With the new changes for 2020 USDA Income limits, the Jefferson County Louisville, KY Metro area (**) saw an increase of $90,300 for a family of four and up to $119,200 for a family of five or more. The metro area surrounding counties of Jefferson County includes Oldham, Bullitt, Spencer are included in these higher income limits for USDA loans.

Remember, the entire Jefferson County and Fayette County Kentucky counties are not eligible for USDA loans. Along with parts of the following counties Daviess (Owensboro), Mccracken (Paducah), Madison County, (Richmond), Clark County (Winchester), Warren (Bowling Green), Hardin (Fort Knox and Radcliff), Bullitt(Hillview, Maryville, Zoneton, Fairdale, Brooks), Franklin, (Frankfort), Henderson (Henderson City Limits), Christian County (Hopkinsville, Fort Campbell), Boyd County (Ashland city limits) and the most Northern Parts of Boone, Kenton, Campbell Counties of Northern Kentucky (Covington, Florence, Richwood, Hebron, Ludlow, Fort Thomas, Bellevue, Ryle, Beechwood, )

The Northern Kentucky Counties (***) of Boon, Kenton, Campbell, Brackenn, Gallatin, and Pendleton are $99,250 for a household of four or less and up to $131,000 for a family of five or more.

USDA Eligible Areas in Northern Kentucky

Burlington

Hebron

Independence

Walton

Alexandria

Highland Heights

Cold Springs

Grant County

Owen County

Pendleton County

Burlington

Hebron

Independence

Walton

Alexandria

Highland Heights

Cold Springs

Grant County

Owen County

Pendleton County

USDA Income Limits

Boone, Kenton & Campbell Counties (N. KY)

$99,250 (family size 1-4)

$131,000 (family size 5 or more)

Boone, Kenton & Campbell Counties (N. KY)

$99,250 (family size 1-4)

$131,000 (family size 5 or more)

Grant, Owen & Pendleton Counties (N. KY)

$90,300 (family size 1-4)

$119,250 (family size 5 or more)

Most are familiar with USDA Rural Housing Loan Program being a great no money down program available and it is not just for Kentucky first time buyers.

$90,300 (family size 1-4)

$119,250 (family size 5 or more)

Most are familiar with USDA Rural Housing Loan Program being a great no money down program available and it is not just for Kentucky first time buyers.

Kentucky USDA Rural Housing Mortgage Lender: Kentucky Rural Housing USDA Maximum Income by Coun...: 2020 Kentucky USDA Loan Income Limits for Kentucky Counties Kentucky USDA loan income limits vary by location and household size wi...

Kentucky VA Home Loans Info

Kentucky VA Home Loans Info: 100% Financing Available available for first time use and subsequent use.

Can use your Kentucky VA loan more than once. Seller can pay up to 4% (of the purchase price) for your closing costs

Must be an Active or Prior Service member (this includes Reservists)

In most cases no Letter of explanation for credit issues and no Verified Rental history is required if it

makes sense to VA underwriters

2 years removed from bankruptcy No minimum score but lenders will create minimum credit overlays.

Current Covid 19 enforcement has caused a lot VA lenders in Kentucky to raise the score to 620

No max loan amounts anymore, but must qualify based on debt to income ratio, entitlement amount, residual income and area you are buying.

Loan is submitted through Desktop Underwriting first, and depending on the recommendation from

the AUS or Automated Underwriting System, it will dedicate your condition to close the loan.

Can use your Kentucky VA loan more than once. Seller can pay up to 4% (of the purchase price) for your closing costs

Must be an Active or Prior Service member (this includes Reservists)

In most cases no Letter of explanation for credit issues and no Verified Rental history is required if it

makes sense to VA underwriters

2 years removed from bankruptcy No minimum score but lenders will create minimum credit overlays.

Current Covid 19 enforcement has caused a lot VA lenders in Kentucky to raise the score to 620

No max loan amounts anymore, but must qualify based on debt to income ratio, entitlement amount, residual income and area you are buying.

Loan is submitted through Desktop Underwriting first, and depending on the recommendation from

the AUS or Automated Underwriting System, it will dedicate your condition to close the loan.

100% Financing Zero Down Payment Kentucky Mortgage Home Loans for Kentucky First time Home Buyers: Score Requirement on Kentucky FHA Loans for people...

100% Financing Zero Down Payment Kentucky Mortgage Home Loans for Kentucky First time Home Buyers: Score Requirement on Kentucky FHA Loans for people...: Lowers Minimum Credit Score Requirement on Kentucky FHA Loans Kentucky FHA Home loan programs for people with bad credit FHA loans are...

Score Requirement on Kentucky FHA Loans for people with bad credit

Lowers Minimum Credit Score Requirement on Kentucky FHA Loans

Kentucky FHA Home loan programs for people with bad credit

FHA loans are designed to make housing more affordable with lower down payment requirements than conventional loans on purchases and less home equity requirements on refinances. Less stringent qualification guidelines and the security of a government-insured loan makes FHA a popular choice for consumers.

Kentucky FHA Loans with 580 Credit scores and – Low Down Payment – 3.5% which can be gifted from relatives or borrowed off one's retirement account. If your scores is between 500-579, 10% down needed for home loan and subject to underwriting approval.

Kentucky First Time Home Buyer Programs For Home Mortgage Loans: KENTUCKY FIRST TIME HOME BUYER REQUIREMENTS MORTGA...

Kentucky First Time Home Buyer Programs For Home Mortgage Loans: KENTUCKY FIRST TIME HOME BUYER REQUIREMENTS MORTGA...: 1. Mortgage Rates Change Just like the stock market, mortgage rates change throughout the day. Mortgage rates you see today may not...

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgage: Kentucky VA Mortgage Loan Information

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgage: Kentucky VA Mortgage Loan Information: Kentucky VA Mortgage Loans What are VA Home Loans? VA Loans provide military veterans and current service members a distinct...

Subscribe to:

Posts (Atom)