Kentucky VA Home Loans offered by a Kentucky Veteran. I have successfully originated over 100 VA Kentucky Mortgages for fellow Kentucky Veterans and active duty personnel.$0 Down Home loans in KY. Free Credit Report and free pre-approvals. I can be reached by text or call at 502-905-3708, or kentuckyloan@gmail.com Not affiliated with VA Government Agency. NMLS #57916 Company NMLS #1738461 Former Army Tanker 19k

Pages

- How to Apply for a Kentucky VA Loan

- Accessibility Statement

- KENTUCKY AND LOUISVILLE VA APPROVED CONDOS

- Things needed for a Kentucky VA Mortgage Loan Approval

- Customer Reviews/Testimonials

- Kentucky VA Home Loan Mortgage New Construction

- Refinancing Louisville Ky VA Loans

- Home

- Privacy And Disclosures

- Mortgage Application Process

- Certificate of Eligibility

- Kentucky VA Loan Requirements

- VA home loan

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgage: Credit Scores Kentucky Mortgage Loan

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgage: Credit Scores Kentucky Mortgage Loan: ∘ What kind of credit score do I need to qualify for different first time home buyer loans in Kentucky? Answer. Mos...

Kentucky USDA Rural Housing Mortgage Lender: Kentucky Rural Housing USDA Maximum Income by Coun...

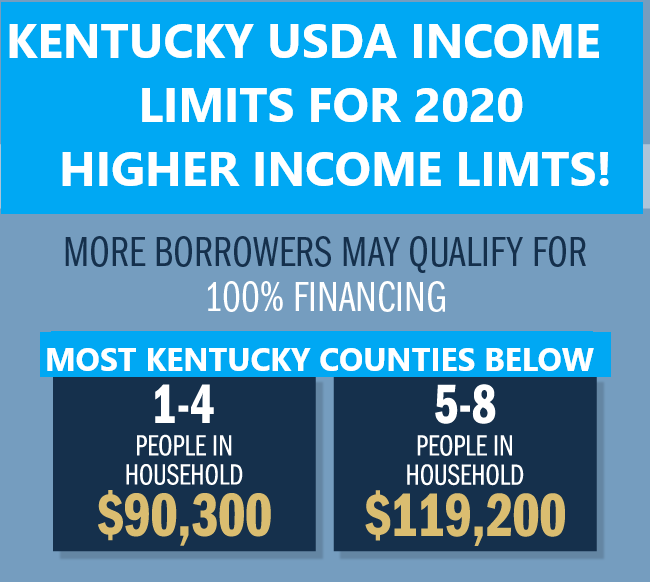

The base USDA income limits are for most Kentucky counties below:

New Income limits for most counties (*) in Kentucky are $90,300 for a household family of four and household families of five or more can make up to $119,200.

With the new changes for 2020 USDA Income limits, the Jefferson County Louisville, KY Metro area (**) saw an increase of $90,300 for a family of four and up to $119,200 for a family of five or more. The metro area surrounding counties of Jefferson County includes Oldham, Bullitt, Spencer are included in these higher income limits for USDA loans.

Remember, the entire Jefferson County and Fayette County Kentucky counties are not eligible for USDA loans. Along with parts of the following counties Daviess (Owensboro), Mccracken (Paducah), Madison County, (Richmond), Clark County (Winchester), Warren (Bowling Green), Hardin (Fort Knox and Radcliff), Bullitt(Hillview, Maryville, Zoneton, Fairdale, Brooks), Franklin, (Frankfort), Henderson (Henderson City Limits), Christian County (Hopkinsville, Fort Campbell), Boyd County (Ashland city limits) and the most Northern Parts of Boone, Kenton, Campbell Counties of Northern Kentucky (Covington, Florence, Richwood, Hebron, Ludlow, Fort Thomas, Bellevue, Ryle, Beechwood, )

The Northern Kentucky Counties (***) of Boon, Kenton, Campbell, Brackenn, Gallatin, and Pendleton are $99,250 for a household of four or less and up to $131,000 for a family of five or more.

USDA Eligible Areas in Northern Kentucky

Burlington

Hebron

Independence

Walton

Alexandria

Highland Heights

Cold Springs

Grant County

Owen County

Pendleton County

Burlington

Hebron

Independence

Walton

Alexandria

Highland Heights

Cold Springs

Grant County

Owen County

Pendleton County

USDA Income Limits

Boone, Kenton & Campbell Counties (N. KY)

$99,250 (family size 1-4)

$131,000 (family size 5 or more)

Boone, Kenton & Campbell Counties (N. KY)

$99,250 (family size 1-4)

$131,000 (family size 5 or more)

Grant, Owen & Pendleton Counties (N. KY)

$90,300 (family size 1-4)

$119,250 (family size 5 or more)

Most are familiar with USDA Rural Housing Loan Program being a great no money down program available and it is not just for Kentucky first time buyers.

$90,300 (family size 1-4)

$119,250 (family size 5 or more)

Most are familiar with USDA Rural Housing Loan Program being a great no money down program available and it is not just for Kentucky first time buyers.

Kentucky USDA Rural Housing Mortgage Lender: Kentucky Rural Housing USDA Maximum Income by Coun...: 2020 Kentucky USDA Loan Income Limits for Kentucky Counties Kentucky USDA loan income limits vary by location and household size wi...

Kentucky VA Home Loans Info

Kentucky VA Home Loans Info: 100% Financing Available available for first time use and subsequent use.

Can use your Kentucky VA loan more than once. Seller can pay up to 4% (of the purchase price) for your closing costs

Must be an Active or Prior Service member (this includes Reservists)

In most cases no Letter of explanation for credit issues and no Verified Rental history is required if it

makes sense to VA underwriters

2 years removed from bankruptcy No minimum score but lenders will create minimum credit overlays.

Current Covid 19 enforcement has caused a lot VA lenders in Kentucky to raise the score to 620

No max loan amounts anymore, but must qualify based on debt to income ratio, entitlement amount, residual income and area you are buying.

Loan is submitted through Desktop Underwriting first, and depending on the recommendation from

the AUS or Automated Underwriting System, it will dedicate your condition to close the loan.

Can use your Kentucky VA loan more than once. Seller can pay up to 4% (of the purchase price) for your closing costs

Must be an Active or Prior Service member (this includes Reservists)

In most cases no Letter of explanation for credit issues and no Verified Rental history is required if it

makes sense to VA underwriters

2 years removed from bankruptcy No minimum score but lenders will create minimum credit overlays.

Current Covid 19 enforcement has caused a lot VA lenders in Kentucky to raise the score to 620

No max loan amounts anymore, but must qualify based on debt to income ratio, entitlement amount, residual income and area you are buying.

Loan is submitted through Desktop Underwriting first, and depending on the recommendation from

the AUS or Automated Underwriting System, it will dedicate your condition to close the loan.

100% Financing Zero Down Payment Kentucky Mortgage Home Loans for Kentucky First time Home Buyers: Score Requirement on Kentucky FHA Loans for people...

100% Financing Zero Down Payment Kentucky Mortgage Home Loans for Kentucky First time Home Buyers: Score Requirement on Kentucky FHA Loans for people...: Lowers Minimum Credit Score Requirement on Kentucky FHA Loans Kentucky FHA Home loan programs for people with bad credit FHA loans are...

Score Requirement on Kentucky FHA Loans for people with bad credit

Lowers Minimum Credit Score Requirement on Kentucky FHA Loans

Kentucky FHA Home loan programs for people with bad credit

FHA loans are designed to make housing more affordable with lower down payment requirements than conventional loans on purchases and less home equity requirements on refinances. Less stringent qualification guidelines and the security of a government-insured loan makes FHA a popular choice for consumers.

Kentucky FHA Loans with 580 Credit scores and – Low Down Payment – 3.5% which can be gifted from relatives or borrowed off one's retirement account. If your scores is between 500-579, 10% down needed for home loan and subject to underwriting approval.

Kentucky First Time Home Buyer Programs For Home Mortgage Loans: KENTUCKY FIRST TIME HOME BUYER REQUIREMENTS MORTGA...

Kentucky First Time Home Buyer Programs For Home Mortgage Loans: KENTUCKY FIRST TIME HOME BUYER REQUIREMENTS MORTGA...: 1. Mortgage Rates Change Just like the stock market, mortgage rates change throughout the day. Mortgage rates you see today may not...

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgage: Kentucky VA Mortgage Loan Information

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgage: Kentucky VA Mortgage Loan Information: Kentucky VA Mortgage Loans What are VA Home Loans? VA Loans provide military veterans and current service members a distinct...

COVID-19, Kentucky VA Home Loan Benefits

VA Announces Special Relief for those Potentially Impacted by COVID-19

VA issued Circular 26-20-7: Special Relief for those Potentially Impacted by COVID-19 (Circular). Per the Circular, loan holders are encouraged to extend forbearance to borrowers in distress as a result of COVID-19. Servicers should work with impacted borrowers who are unable to make their mortgage payments to ensure they are evaluated for VA Loss Mitigation options. In addition, servicers are encouraged to suspend credit bureau reporting and to adopt policies that waive late charges for affected loans.

Special Relief for those Potentially Impacted by COVID-19

1. Purpose. The Department of Veterans Affairs (VA) is working with other federal partners to assess next steps in response to recent reports of cases of Coronavirus Disease 2019 (COVID-19) in the United States. To keep Veterans and stakeholders safe while continuing the mission of VA Home Loan Program, VA is providing the following information. Please note, VA is continuing with normal program operations and information will be shared as updates are made available regarding the VA Home Loan program.

2. Veterans. If you have an in-person appointment scheduled with your lender, servicer, appraiser, or VA staff and answer “yes” to any of the following questions, please call the point of contact before your scheduled appointment.

a. Are you having flu-like symptoms, such as fever, cough, or shortness of breath?

b. In the last 14 days, have you traveled to a high-risk area for transmission of COVID-19?

c. Have you been in close contact with someone confirmed to have COVID-19 or who is being evaluated for COVID-19?

In lieu of conducting a face-to-face meeting, VA will make every effort to conduct meetings by telephone. However, VA may have to postpone the meeting or Veterans may request to have a meeting postponed based on circumstances.

3. Lenders and Servicers. Lenders should have continuity of operation plans in place to support ongoing ability to conduct business operations in the event of an interruption to business operations and processes. Servicers may employ the following relief for Veterans impacted by COVID-19:

a. Forbearance Request. VA encourages holders of guaranteed loans to extend forbearance to borrowers in distress as a result of COVID-19. We understand the impact may be temporary, but it is still a hardship.

Servicers should work with impacted borrowers who are unable to make their mortgage payments to ensure they are evaluated for VA Loss Mitigation options outlined in Chapter 5 of the VA Servicer Handbook M26-4, https://www.benefits.va.gov/WARMS/M26_4.asp. VA encourages the proper use of authorities granted in VA regulations to provide assistance in appropriate cases.

For example, Title 38, Code of Federal Regulations (CFR), section 36.4311 allows the reapplication of prepayments to cure or prevent a default. Also, 38 CFR 36.4315 allows the terms of any guaranteed loan to be modified without the prior approval of VA, provided conditions in the regulation are satisfied.

Circular 26-20-7 March 16, 2020

b. Late Charge Waivers. VA believes that many servicers plan to waive late charges on affected loans and encourages all servicers to adopt such a policy for any loans that may have been affected.

c. Credit and VA Reporting. In order to avoid damaging credit records of Veteran borrowers, servicers are encouraged to suspend credit bureau reporting on affected loans. Please contact the appropriate Regional Loan Center (RLC) with any questions.

4. Appraisers. Appraisers should continue to conduct business as outlined in Chapter 10 of the M26-

7, Lender’s Handbook, https://www.benefits.va.gov/WARMS/pam26_7.asp.

If you have an appointment scheduled and answer “yes” to any of the following questions, please contact the RLC of jurisdiction or the point of contact for the scheduled appointment to determine whether the appointment needs to be rescheduled or whether the assignment should be reassigned.

a. Are you having flu-like symptoms, such as fever, cough, or shortness of breath?

b. In the last 14 days, have you traveled to a high-risk area for transmission of COVID-19?

c. Have you been in close contact with someone confirmed to have COVID-19 or who is being evaluated for COVID-19?

The Centers for Disease Control and Prevention has advised the best way to prevent illness is to take preventative measures. When onsite, appraisers are encouraged to observe the following measures to help prevent the spread of respiratory diseases including the novel COVID-19:

a. Before and after exiting the home, use an alcohol-based hand sanitizer with at least 60 percent alcohol.

b. Avoid close contact with individuals who may be present in the home which includes no handshakes or fist bumps.

c. Avoid touching your eyes, nose, and mouth.

d. Cover your cough or sneeze with a tissue, then throw the tissue in the trash and immediately clean your hands with a hand sanitizer that contains at least 60 percent alcohol.

Please contact the RLC of jurisdiction if you have been impacted by COVID-19 and are unable to complete your appraisal assignments. The email addresses for each of the RLCs are available at: https://www.benefits.va.gov/HOMELOANS/contact_rlc_info.asp.

Subscribe to:

Comments (Atom)