Kentucky VA Mortgage Lender Guide

1. WHAT KIND OF CREDIT SCORE DO YOU NEED TO GET APPROVED FOR A VA MORTGAGE LOAN IN KENTUCKY?

Most VA mortgage lenders in Kentucky are looking for at least a 620 credit score for a VA loan approval. However, VA in their official published guidelines for credit scores says they don’t have a minimum credit. What happens with VA Lenders they will create credit overlays to push out lower credit score borrowers because if they do too many VA loans that default, then they run the risk of getting shut out from VA from them insuring their loans.

FICO credit scores range from 300 to 850. Most borrowers are in the 600 to 700 ranges with very few in the 300 to 400 range and few limited 800 scores.

It pays to shop around with different VA lenders in Kentucky to see what their minimum credit score requirements are.

2. Who is eligible for a VA Mortgage loan in Kentucky?

Kentucky Veterans, active duty servicemembers, reservists, National Guard members, surviving spouses, and other individuals can earn eligibility for home loan benefits. You may qualify if you are:

- Military veteran

- Active duty servicemember

- Reservist or National Guard member

- Surviving spouse who did not remarry

- Academy cadet or midshipman

- National Oceanic and Atmospheric Administration (NOAA) officer

- Public Health Service (PHS) Officer

In order to obtain a Kentucky VA loan, you’ll need a

Certificate of Eligibility, which you can apply for online or we can get for you with your info. Usually comes back instantly, no waiting around like it use to be for it to come in the mail.

3. Can you get a Kentucky VA Mortgage loan more than once?

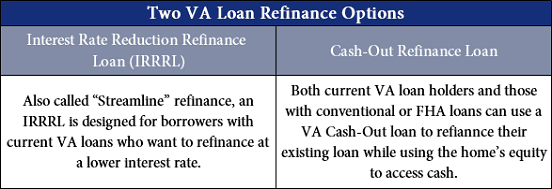

If you are deemed eligible for a Kentucky VA loan, the benefit is yours for life, and in some cases, it can be used multiple times at once. Many veterans use it repeatedly for their home financing needs. Use it for a starter home, then use it again when you’re ready for more space. THEN you can use it again to refinance your loan for a lower rate or get cash out of your home’s equity. It’s completely up to you.

When you use your VA COE again to buy another home, there is an increase in the funding fee from 2.15% to 3.3% for regular veteran and active duty if not on VA disability have a waiver of the VA funding fee.

KENTUCKY VETERANS ARE GUARANTEED VA MORTGAGE LOAN

No one is guaranteed a loan. Even veterans with VA entitlement.

The word “guaranty” comes up a lot when talking about Kentucky VA loans. Well, I’m here to tell you that a “guaranty” and a “guarantee” are not the same thing. Many people assume when they see

“VA loan guaranty” that they’re guaranteed a VA loan, and that’s simply not the case.

The VA loan guaranty refers to the amount of each VA loan that is backed by the government (usually 25%). If the loan defaults, the amount under guaranty is refunded to the lender by the government. So just because you see guaranty, doesn’t mean your loan is guaranteed to be approved.

HOW LONG DOES VA APPRAISAL PROCESS?

Fact: The

VA appraisal process can be rough if you’re pursuing a home that’s in rough shape. Otherwise, the VA appraisal process isn’t much different from the average Conventional appraisal.

VA loan appraisers use the VA’s “

Minimum Property Requirement” guidelines to determine if a home is safe, structurally sound, and sanitary. If the home doesn’t meet their standards, the process can take a while. That’s why it’s important to choose your home wisely. A few of the MPRs include:

- Plumbing and electrical systems must be safe and in good condition

- Heating must be adequate

- Roofing must be adequate

- No leaks, excessive dampness, defective construction, or decay

- No termites, destructive insects, fungus growth, or dry rot

Kentucky VA loans aren’t designed to fund fixer-uppers. The VA wants veterans and servicemembers to buy solid, move-in ready homes, not projects. Also, since most VA borrowers are putting no money down, they don’t want to take the risk of borrower walking away with no equity in the home.

American Mortgage Solutions, Inc.

10602 Timberwood Circle Suite 3

Louisville, KY 40223

Company ID #1364 | MB73346

If you are an individual with disabilities who needs accommodation, or you are having difficulty using our website to apply for a loan, please contact us at 502-905-3708.

Disclaimer: No statement on this site is a commitment to make a loan. Loans are subject to borrower qualifications, including income, property evaluation, sufficient equity in the home to meet Loan-to-Value requirements, and final credit approval. Approvals are subject to underwriting guidelines, interest rates, and program guidelines and are subject to change without notice based on applicant’s eligibility and market conditions. Refinancing an existing loan may result in total finance charges being higher over the life of a loan. Reduction in payments may reflect a longer loan term. Terms of any loan may be subject to payment of points and fees by the applicant Equal Opportunity Lender. NMLS#57916

http://www.nmlsconsumeraccess.org/

— Some products and services may not be available in all states. Credit and collateral are subject to approval. Terms and conditions apply. This is not a commitment to lend. Programs, rates, terms and conditions are subject to change without notice. The content in this marketing advertisement has not been approved, reviewed, sponsored or endorsed by any department or government agency. Rates are subject to change and are subject to borrower(s) qualification.