Kentucky VA Home Loans offered by a Kentucky Veteran. I have successfully originated over 100 VA Kentucky Mortgages for fellow Kentucky Veterans and active duty personnel.$0 Down Home loans in KY. Free Credit Report and free pre-approvals. I can be reached by text or call at 502-905-3708, or kentuckyloan@gmail.com Not affiliated with VA Government Agency. NMLS #57916 Company NMLS #1364 Former Army Tanker 19k

Pages

- How to Apply for a Kentucky VA Loan

- Accessibility Statement

- KENTUCKY AND LOUISVILLE VA APPROVED CONDOS

- Things needed for a Kentucky VA Mortgage Loan Approval

- Customer Reviews/Testimonials

- Kentucky VA Home Loan Mortgage New Construction

- Refinancing Louisville Ky VA Loans

- Home

- Privacy And Disclosures

- Mortgage Application Process

- Certificate of Eligibility

- Kentucky VA Loan Requirements

- VA home loan

Showing posts with label Kentucky VA Loan Guidelines. Show all posts

Showing posts with label Kentucky VA Loan Guidelines. Show all posts

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgage: Kentucky Mortgage Down Payment Requirements

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgage: Kentucky Mortgage Down Payment Requirements: If you’re a Kentucky first-time homebuyer looking for low down payment mortgage options, several may be available to you. In fact, many o...

Kentucky VA Funding Fee Changes for 2020 Mortgages

The Kentucky VA funding fee status is specified on the Certificate of Eligibility (COE). The standard funding fees as shown

below may be financed in the loan amount. The COE indicates the exempt status as follows:

• A Veteran receiving disability compensation (or would be eligible for disability, but is receiving

retirement pay or active service pay)

• A surviving spouse of any Veteran who died during active duty or from a service-connected disability.

The surviving spouse must be in receipt of the Dependency and Indemnity Compensation

• A Veteran who is rated as eligible to receive compensation from a pre-discharge disability examination

or review of existing medical evidence that results in the issuance of a memorandum rating before the

loan closes

If the COE does not reflect the exemption and the Veteran believes he/she is exempt, obtain the following:

• An updated COE within three days of closing using the ‘Correct’ function in WebLGY, or

• For an active duty service member who indicates they have a pre-discharge claim pending, the RLC must

be contacted by email to assist with obtaining a proposed or memorandum rating to determine if the

Service member may be exempt from paying the funding fee. If a proposed or memorandum rating is

not obtained prior to closing, the Service member will not be eligible for a funding fee exemption

Funding Fees

Type of Loan Down Payment First-time Use Subsequent Use

Purchase & Construction Loans

COVID-19, Kentucky VA Home Loan Benefits

VA Announces Special Relief for those Potentially Impacted by COVID-19

VA issued Circular 26-20-7: Special Relief for those Potentially Impacted by COVID-19 (Circular). Per the Circular, loan holders are encouraged to extend forbearance to borrowers in distress as a result of COVID-19. Servicers should work with impacted borrowers who are unable to make their mortgage payments to ensure they are evaluated for VA Loss Mitigation options. In addition, servicers are encouraged to suspend credit bureau reporting and to adopt policies that waive late charges for affected loans.

Special Relief for those Potentially Impacted by COVID-19

1. Purpose. The Department of Veterans Affairs (VA) is working with other federal partners to assess next steps in response to recent reports of cases of Coronavirus Disease 2019 (COVID-19) in the United States. To keep Veterans and stakeholders safe while continuing the mission of VA Home Loan Program, VA is providing the following information. Please note, VA is continuing with normal program operations and information will be shared as updates are made available regarding the VA Home Loan program.

2. Veterans. If you have an in-person appointment scheduled with your lender, servicer, appraiser, or VA staff and answer “yes” to any of the following questions, please call the point of contact before your scheduled appointment.

a. Are you having flu-like symptoms, such as fever, cough, or shortness of breath?

b. In the last 14 days, have you traveled to a high-risk area for transmission of COVID-19?

c. Have you been in close contact with someone confirmed to have COVID-19 or who is being evaluated for COVID-19?

In lieu of conducting a face-to-face meeting, VA will make every effort to conduct meetings by telephone. However, VA may have to postpone the meeting or Veterans may request to have a meeting postponed based on circumstances.

3. Lenders and Servicers. Lenders should have continuity of operation plans in place to support ongoing ability to conduct business operations in the event of an interruption to business operations and processes. Servicers may employ the following relief for Veterans impacted by COVID-19:

a. Forbearance Request. VA encourages holders of guaranteed loans to extend forbearance to borrowers in distress as a result of COVID-19. We understand the impact may be temporary, but it is still a hardship.

Servicers should work with impacted borrowers who are unable to make their mortgage payments to ensure they are evaluated for VA Loss Mitigation options outlined in Chapter 5 of the VA Servicer Handbook M26-4, https://www.benefits.va.gov/WARMS/M26_4.asp. VA encourages the proper use of authorities granted in VA regulations to provide assistance in appropriate cases.

For example, Title 38, Code of Federal Regulations (CFR), section 36.4311 allows the reapplication of prepayments to cure or prevent a default. Also, 38 CFR 36.4315 allows the terms of any guaranteed loan to be modified without the prior approval of VA, provided conditions in the regulation are satisfied.

Circular 26-20-7 March 16, 2020

b. Late Charge Waivers. VA believes that many servicers plan to waive late charges on affected loans and encourages all servicers to adopt such a policy for any loans that may have been affected.

c. Credit and VA Reporting. In order to avoid damaging credit records of Veteran borrowers, servicers are encouraged to suspend credit bureau reporting on affected loans. Please contact the appropriate Regional Loan Center (RLC) with any questions.

4. Appraisers. Appraisers should continue to conduct business as outlined in Chapter 10 of the M26-

7, Lender’s Handbook, https://www.benefits.va.gov/WARMS/pam26_7.asp.

If you have an appointment scheduled and answer “yes” to any of the following questions, please contact the RLC of jurisdiction or the point of contact for the scheduled appointment to determine whether the appointment needs to be rescheduled or whether the assignment should be reassigned.

a. Are you having flu-like symptoms, such as fever, cough, or shortness of breath?

b. In the last 14 days, have you traveled to a high-risk area for transmission of COVID-19?

c. Have you been in close contact with someone confirmed to have COVID-19 or who is being evaluated for COVID-19?

The Centers for Disease Control and Prevention has advised the best way to prevent illness is to take preventative measures. When onsite, appraisers are encouraged to observe the following measures to help prevent the spread of respiratory diseases including the novel COVID-19:

a. Before and after exiting the home, use an alcohol-based hand sanitizer with at least 60 percent alcohol.

b. Avoid close contact with individuals who may be present in the home which includes no handshakes or fist bumps.

c. Avoid touching your eyes, nose, and mouth.

d. Cover your cough or sneeze with a tissue, then throw the tissue in the trash and immediately clean your hands with a hand sanitizer that contains at least 60 percent alcohol.

Please contact the RLC of jurisdiction if you have been impacted by COVID-19 and are unable to complete your appraisal assignments. The email addresses for each of the RLCs are available at: https://www.benefits.va.gov/HOMELOANS/contact_rlc_info.asp.

Kentucky VA Mortgage Guidance for Covid-19 in regards to Appraisals and Income.

Reference:

VA Circular 26-20-10, Lender Guidance for Borrowers Affected by COVID-19

VA Circular 26-20-11, Valuation Practices during COVID-19

Kentucky Mortgages for VA published guidance for lenders during the current market environment.:

Appraisal Guidance

VA’s temporary appraisal flexibilities announced in Circular 26-20-11. If appraisal flexibility is needed, when placing the appraisal order, the originator (broker or other) must make a public note in WebLGY and send an email to the appraiser once assigned that states that a Desktop Appraisal will be accepted by the lender. Originators should review and become familiar with the specific criteria to take advantage of the flexibilities.

Income Guidance

VA loans to take advantage of the alternative reverification forms as stated below only.

• Email from the employer’s work email address that identifies the name and title of the verifier and the borrower’s name and current employment status in lieu of the verbal OR

• YTD paystub from the pay period that immediately precedes the Note date OR

• Payroll deposit on the bank statement evidencing the payroll deposit from the pay period that immediately precedes the Note date

VA Circular 26-20-10, Lender Guidance for Borrowers Affected by COVID-19

VA Circular 26-20-11, Valuation Practices during COVID-19

Kentucky Mortgages for VA published guidance for lenders during the current market environment.:

Appraisal Guidance

VA’s temporary appraisal flexibilities announced in Circular 26-20-11. If appraisal flexibility is needed, when placing the appraisal order, the originator (broker or other) must make a public note in WebLGY and send an email to the appraiser once assigned that states that a Desktop Appraisal will be accepted by the lender. Originators should review and become familiar with the specific criteria to take advantage of the flexibilities.

Income Guidance

VA loans to take advantage of the alternative reverification forms as stated below only.

• Email from the employer’s work email address that identifies the name and title of the verifier and the borrower’s name and current employment status in lieu of the verbal OR

• YTD paystub from the pay period that immediately precedes the Note date OR

• Payroll deposit on the bank statement evidencing the payroll deposit from the pay period that immediately precedes the Note date

Generally, mortgage borrowers in 2020 need to do two things: understand the loan they’re applying for and be able to demonstrate their ability to repay it.

By Michele Lerner

March 27, 2020 at 7:00 a.m. EDT

The global coronavirus, which initially dropped mortgage rates to new lows, led to a rush to refinance that overwhelmed lenders. Rates increased when lenders couldn’t handle the volume of loans. Now that the pandemic is impacting the United States, borrowers should anticipate a slowdown in mortgage closings because everyone is working from home and still attempting to process an overload of loan applications.

Generally, mortgage borrowers in 2020 need to do two things: understand the loan they’re applying for and be able to demonstrate their ability to repay it.

“I’m a huge fan of loan preapprovals and I think everyone should get two or three unbiased opinions from lenders about mortgage options before they fall in love with a house,” says Anna DeSimone, author of “Housing Finance 2020: New Mortgage Programs for the New Generation of Homebuyers,” and a housing finance consultant in New York City. “It’s like going on a job interview where you can ask and answer questions.”

Mortgage approvals are generally based on your FICO credit scores, your loan-to-value (which varies according to the size of your down payment and the appraised value of the house) and your debt-to-income ratio. Your debt-to-income ratio is a measure of the minimum payments on your credit card debt, loans and housing payment compared to your gross monthly income. Meeting in person with a lender can help you understand what it takes to qualify for a mortgage.

AD

“If you just complete an online form for a loan, that won’t capture some of the compensating factors that a lender may consider in your favor,” says DeSimone. “For example, an automated system may require a credit score of 680 for a loan with 5 percent down, but if you have a retirement account with six months’ worth of mortgage payments that could allow an approval with a lower credit score.”

DeSimone says mortgage applications today list 20 different types of acceptable income, such as seasonal work, rental income from boarders and part-time jobs — in greater recognition of the reality of the ways people earn money. The income must be documented with bank statements or other paperwork.

“Lenders have different standards and will offer different rates and programs, so there’s no substitute for shopping around for a loan,” says Guy Cecala, chief executive and publisher of Bethesda-based Inside Mortgage Finance Publications. “It’s important to talk to more than one lender and to do it before you’re ready to apply for a loan because the credit score the mortgage lender pulls tends to be more comprehensive than the one you see online. It can be hard to calculate your own debt-to-income ratio because the lender only counts some types of debt.”

AD

The average FICO score for approved mortgage loans has remained relatively steady in recent years, ranging from 723 in 2017 to 731 in 2019, according to Joe Tyrrell, chief operating officer of Ellie Mae, a technology provider for mortgage companies headquartered in Pleasanton, Calif. The average debt-to-income ratio for approved mortgage loans was 39 percent in 2017 and 38 percent in 2019.

“Even though access to home buying has improved with the availability of more low-down-payment loans, lenders are not compromising on the credit quality of applicants,” says Tyrrell.

Federal Housing Administration (FHA) loans have more lenient requirements than conventional loans, which are purchased by Fannie Mae and Freddie Mac. Fannie Mae and Freddie Mac are the government-sponsored entities that operate under the authority of the Federal Housing Finance Agency and purchase the majority of mortgage loans made in the United States.

AD

“FHA loans are a great option for people with lower FICO scores,” says Jeremy Sopko, CEO of Nations Lending, headquartered in Independence, Ohio. “The average FICO score for our customers is 680 but we also provide loans to people with credit scores of 580 and below. In that case, though, we expect them to come to the table with their own funds for the down payment. If someone has a low credit score and they’re getting their down payment from their family, then they don’t have any meat into the loan.”

FICO score changes

Fair Isaac Corp., which issues FICO credit scores, recently announced new credit scoring models (FICO 10 and FICO 10T) that will be used by all three credit reporting bureaus (Equifax, Experian and TransUnion) by the end of the year. FICO scores impact mortgage lending in two ways. First, a low score can disqualify a borrower from many loan programs. Second, the interest rate paid for conventional loans depends on FICO scores. The lowest mortgage rates are reserved for borrowers with a credit score of 760 or above, according to MyFICO.com.

AD

“Mortgage lenders use an older FICO scoring model rather than the most recent model, so the impact of the new scoring model isn’t likely to be felt right away,” says Tyrrell. “But the new FICO 10T version could have an impact on future borrowing because it looks at trended data rather than a snapshot of what a borrower looks like right now.”

Trended data examines the pattern of debt repayment over two years. Consumers who pay credit card bills in full each month are likely to see a boost in their credit score, while those who carry a balance or pay off their debt and then accrue more debt are likely to see a drop in their credit score with the new model, according to Tyrrell.

“Fannie Mae and Freddie Mac have a mandate to change credit score models, but the process is just beginning,” says Ed Pinto, director of the American Enterprise Institute’s Housing Center in Washington, D.C. “They have three years to make the change and a two-year implementation period, so FICO can come out with anything they want but there will be a delay on the mortgage end.”

AD

Much of the blame for the 2008 financial crisis fell on unusual mortgages, such as “choose-your-own-payment” and no-income verification loans, also known as “liar’s loans.” While those types of loans are not widely available, in 2019 unconventional loans represented $52 billion in loan volume, the highest level since the housing crisis, says Cecala. However, that’s still a relatively small number — less than 3 percent of the overall mortgage volume for the year.

Today’s unconventional loans include those that rely on bank statements instead of tax returns to verify income and asset-based loans for high-net-worth families, says Tyrell, but they’re not readily available to most borrowers.

“Before the housing crisis, more than a third of all loans were unconventional and they were offered by all lenders as part of their product mix,” says Cecala. “Now most lenders are doing a good job underwriting the loans, especially because there’s so little investor interest in these loans that the lenders hold them themselves. That imposes discipline because the lenders don’t want to lose money. For instance, you do see some interest-only loans, but they’re typically only approved for well-heeled buyers with high incomes and high credit scores.”

AD

One measure of the state of mortgage lending is delinquencies, which refer to loans with payments that are 30 days or more past due. In January 2020, mortgage delinquencies hit their lowest level on record, dating back to 2000, according to Black Knight, a software and data analytics provider. The number of loans with late payments declined 14 percent in January 2020 compared with January 2019, an indication of both a strong economy and high standards for loan approvals.

“Today’s unconventional loans aren’t as risky as in the early 2000s because lenders are more careful now and won’t loan 100 percent of the value of the home to someone based on their bank statements,” says Sopko. “Now you’ll need a down payment or home equity of 30 or 40 percent for those kinds of loans.”

Changes in 2021

The existence of fewer risky mortgages today stems from post-crisis regulations as well as lender skittishness over the massive losses they incurred during the housing crisis. One part of those regulations protects borrowers from predatory lending and provides safety for lenders from lawsuits as long as they follow the rules for a “qualified mortgage” or “QM” loan. QM loans meet a long list of requirements, such as no balloon payments, no interest-only periods and set a maximum debt-to-income ratio of 43 percent.

AD

However, loans that would be purchased by Fannie Mae and Freddie Mac are exempt from the maximum debt-to-income ratio of 43 percent set by the QM rule — if borrowers met all other requirements to demonstrate their ability to repay the loan. That exemption is scheduled to be lifted in January 2021.

“That 43 percent was set because it’s basically the mortgage standard without any compensating factors, but if you had good income and good reserves or a down payment of 50 percent, a ratio higher than 43 percent might be okay,” says Cecala.

The possibility of this exemption, known as the “QM patch,” expiring without modification by the Consumer Financial Protection Bureau is unlikely, according to Cecala and most industry experts. The concern, says Cecala, is that fewer borrowers would qualify if the maximum debt-to-income ratio of 43 percent was enforced for conventional loans.

On the other hand, some observers worry the CFPB could get rid of the debt-to-income ratio requirement.

“If the debt-to-income ratio requirement is eliminated, then lenders are less likely to manage risk,” says Pinto. “My concern is that too-easy credit could return.”

Another possible outcome if the QM patch is lifted next year would be an increased number of private non-QM loans, says Sopko, which could be risky.

Changes to loan regulations, new FICO scoring models and the return of unconventional loans are all something to keep an eye on over the next year or two, says Sopko. In the meantime, mortgage borrowers should be sure they understand their credit and finances before they begin to look for a home.

Some advice for borrowers applies no matter what happens in the mortgage industry, such as:

● Check your credit report. Get your free credit reports from each of the credit bureaus at www.annualcreditreport.com to look for errors. You can also pay for a credit score at that time or get a free credit score from your bank or credit card company, but keep in mind that score is likely to be different from the score a lender will see.

● Prepare your documents. Many loan applications are handled online with secure portals where you can upload your documents. You’ll need to know how to access your most recent paystubs, tax returns and statements for all your bank and investment accounts. If you’re self-employed or rely on alimony or child support for income, you’ll need additional documentation.

● Check for down payment assistance programs. You can check with your state or local government or with DownPaymentResource.com. DeSimone says there are programs for people with incomes higher than $100,000 in 43 states. “Not checking for home buyer programs is like accepting a college admission without asking about financial aid,” she says.

● Shop for loan information. Take a copy of your annual credit report and credit score to several lenders so they can get a general idea of your credit profile and your loan options without requesting a credit report, recommends DeSimone. If you appear to be applying for multiple loans, that can damage your credit score, so wait to apply until you’re ready to seriously shop for a home.

● Explore all your loan options. Borrowers who are low on cash have a variety of loans available, including some with zero down payment required (such as VA loans for veterans and USDA loans for buyers in rural areas) and low down payment loans from FHA, Freddie Mac and Fannie Mae. Many financial institutions have special loan programs for first-time buyers and repeat buyers.

Avoid overextending your budget. Pinto says he worries that weaker buyers could be in danger if a recession hits, particularly since the United States is in the ninth year of a boom cycle. “Don’t stretch to buy,” says Pinto. “Try to stay within your budget to reduce your exposure to debt or come up with a bigger down payment so you have more equity.

Benefits at a Glance at Kentucky VA Mortgage Loan

Kentucky VA Mortgage Loan

Created to help more veterans buy their first homes at an affordable cost, the VA loan packs a lot of bang for the buck. From its flexible and generous lending requirements to its low interest rates and closing costs, VA loans are one of the most popular choices among first-time homebuyers with a military background.

Perhaps the biggest advantages to a VA loan are the 100 percent financing (no down payment necessary) and no mortgage insurance requirement. Both of these benefits can save you big bucks now and hundreds of dollars over the life of the loan.

Benefits at a Glance at Kentucky VA Mortgage Loan

No down payment required – 100% financing

Flexible credit and qualifying guidelines – you don’t need to have perfect credit to qualify

Lower interest rates – typically well below most conventional loan options

No monthly mortgage insurance

Finance the funding fee – ability to roll the funding fee into your loan

Seller can pay up to 4% closing costs

Gift money can be used for closing costs and pre-paid items

No pre-payment penalty - sell or refinance anytime without paying a penalty

100% cash-out refinance, including the funding fee: Use your home’s value and pull cash out to pay off debt, make repairs to your home, remodel or spend otherwise.

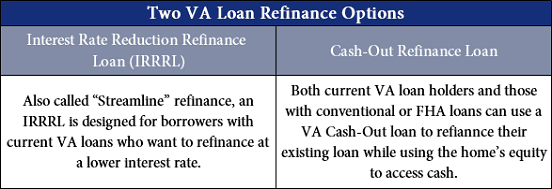

Kentucky VA Streamline Refinances

|

|

|

|

|

|

Louisville Kentucky VA Home Loans Frequently Asked Questions

Louisville Kentucky VA Home Loans Frequently Asked Questions

Frequently Asked Questions

- What is a COE? Where can I get one?

- COE stands for Certificate of Eligibility. This certificate proves that you are a veteran and, therefore, eligible for a VA-guaranteed home loan. Mortgage companies that work with AllMilitary can get a COE for you during the loan process.

How do interest rates fluctuate?

Interest rates can change daily, sometimes even a couple times a day. They are based on the 30-year mortgage bond and many other market factors. Credit, employment status, loan program and many other factors can also affect interest rates.Why should I use my VA home loan benefit?

The VA loan program helps active duty and retired military personnel purchase homes. The VA will guarantee 100% financing on a home at a competitive rate, without you having to pay mortgage insurance. The VA also limits the types of fees that can be charged, protecting you against predatory lending.What is a funding fee? Do I have to pay for this?

The VA funding fee is a fee added to loans. The Department of Veterans Affairs uses these fees to help fund its VA loan program. The first time you use a VA loan, the funding fee will be 2.15% of the loan amount. For each subsequent use, the funding fee will be 3.3%. You will be required to pay it, unless you have a service-related disability of 10% or greater, in which case the funding fee is waived.What does a VA lender need from me to see if I qualify for a loan?

A VA lender will want to know your income and debts, and your social security number so that your credit history can be checked. After you supply this information to a lender, it will contact you in a few hours to let you know if you are eligible for a VA loan.What are the benefits of a VA loan?

A VA loan offers 100% financing with no mortgage insurance fees. The loan is assumable, and you are eligible for streamlined refinancing if rates go down. A VA loan also offers great rates and is less strict on credit than most conventional loans.

Can I get an interest-only loan?

Interest-only options are unvailable with VA loans. However, many VA-approved lenders offer interest-only conventional loans.Can I purchase only land with a VA loan?

No, VA loans are for home purchases and new home construction. The VA will not approve a loan that is only for land. However, you may use a VA loan to purchase a lot for a manufactured home.May I use my VA eligibility more than once?

Yes, but in most cases you can only hold one VA loan at a time. After the first home loan is paid in full, your eligibility will be restored for another loan.What is the funding fee for a second VA loan?

The funding fee is 3.3 %. But with a 5% down payment, the funding fee drops to 1.5%.How important is my credit score to the VA?

The VA does not emphasize credit scores as much as conventional lenders. However, it does looks for a clear credit history in the borrower's previous 12 months.Can a family member use their grandparent's or parent's eligibility to qualify for a VA loan?

No, only a veteran or the surviving spouse of a veteran killed during active duty is eligible for VA loan benefits. Active duty servicemembers also are eligible if the home they are purchasing will be a permanent residence and they are within 60 days of moving in.Can I use a co-borrower to help get approval?

VA guidelines only allow a spouse as a co-borrower. However, many VA-approved lenders offer conventional financing, which may be more suitable if a co-borrower other than a spouse is needed to secure a loan.May my spouse co-sign so that I can get a larger VA loan?

Your spouse may co-sign in order to help you qualify for a VA loan. However, your spouse's liabilities, in addition to your spouse's income, will be considered when determining eligibility and loan amount.

Can I have two VA loans at once?

No. You can have only one VA loan at a time, and it must be used for a home that is your primary residence. After you pay off that loan, you are eligible for another VA loan.Does it cost anything to prequalify for a VA loan?

No, it does not. The VA loan specialists that work with VAJoe do not charge prequalification fees.What are the differences between VA loans and a conventional loans?

The main differences are that VA loans are guaranteed by the Veterans Administration, they require no money down, and they usually are easier to qualify for than conventional loans.Are VA loan rates the same as conventional rates? Better? Worse?

Some days VA rates are better, some days they are worse. It depends on many market factors. However, VA loan rates are always close to conventional rates.Does my credit score affect my VA loan rate?

No. Your credit score has no impact on VA loan rates. It can affect rates for a conventional loan.If I filed bankruptcy, can I still get a VA loan? How long must I wait after filing?

Yes, you are still eligible for a VA loan. You must be at least one year out of Chapter 13 bankruptcy or two years out of Chapter 7. You also must have no late payments in the year leading up to applying for the loan.Can a friend co-sign my VA loan?

Only spouses can co-sign on VA loans. However, other loans, such as conventional home loans and FHA loans, may allow a friend to co-sign.As a veteran, will my VA loan entitlement ever expire?

Your entitlement never expires. However, your Certificate of Eligibility may need to be renewed if it is older than 12 months.How much can I borrow with a VA home loan?

You may be able to borrow enough to cover 100% of your home purchase and could qualify for up to a $417,000 loan. In Alaska and Hawaii, the loan guarantee limit is $625,000. On a refinance you can borrow up to 90% of the appraised value of your home.May I use a VA loan to invest in real estate?

A VA loan may only be used for a home that you intend to live in as your primary residence.Are VA loans provided by the U.S. government?

The Department of Veterans Affairs does not actually loan the money for VA loans. It insures loans that VA-approved lenders provide, which allows borrowers to get loan amounts for 100% of the appraised value of a home.

What is an adjustable-rate VA loan?

An adjustable-rate loan starts off at a slightly lower interest rate than a fixed-rate loan. Most often it stays at this rate for three, five or seven years. After that, the interest rate changes every year to the current interest rate.What is a fixed-rate VA loan?

A fixed-rate loan has an interest rate that stays the same. The interest rate at the time the loan is finalized is the interest rate for the life of the loan.Do I need a down payment with a VA loan?

A VA loan covers 100% of the value of a home, so a down payment is not required. However, you have to pay any closing costs. But the seller can pay these closing costs for you up to an amount that equals 6% of the home's value. This usually is more than enough to cover closing costs, so you can move into a home with no money out of pocket.May I use a VA loan for a vacation home?

No, a VA loan can only be for your primary residence.If I am on active duty, can I get a VA loan?

Yes, if the home will be your permanent residence and you are within 60 days of moving in.My realtor has implied that VA appraisers do poor work. Is this true?

No. VA appraisers protect buyers. VA loans are government-backed, so VA appraisers need to make sure homes meet government safety and quality guidelines

How to Get Your DD214 Form For A Kentucky VA Mortgage Loan?

Follow the steps below to submit a military records request.

From your signed-in homepage, click or tap on Correspondence/ Documentation. Then select Defense Personnel Records Information (DPRIS) from the drop-down menu.

Choose the Personnel File tab.

Select Request My Personnel File.

Fill out the form. In the Document Index section, check the boxes next to the document(s) you'd like to request.

Click or tap on the Create and Send Request button.

What types of records can I request with this tool?

You can request documents from your Official Military Personnel File to view and download.

You can request your:

DD214

DD215

Report of Separation

Other release papers

You can also request documents with information about your service, such as your:

Orders and endorsements

Performance reports

Awards and decorations (commendatory items)

Qualifications, licenses, and certificates

Security clearance

What happens after I request my military records?

You’ll receive an email letting you know we’re processing your request. You’ll receive a second email when your request is complete and your files are ready for you to view and download.

You can also check the status of your military records request by signing in to milConnect and going to the Personnel File tab within the Defense Personnel Records Information (DPRIS) section. This is also where you’ll view and download your files once they’re ready.

Are there other ways to get my military records?

Yes.

You can request your military records in any of these ways:

Mail or fax a Request Pertaining to Military Records (Standard Form SF 180) to the National Personnel Records Center (NPRC).

Download Form SF 180 (PDF)

Write a letter to the NPRC. Send it to:

1 Archives Drive

St. Louis, Missouri 63138

Visit the NPRC in person

Contact your state or county Veterans agency

Hire an independent researcher

How do I request someone else’s military records?

If you’re a family member planning a burial for a Veteran in a VA national cemetery

Call our National Cemetery Scheduling Office at 800-535-1117. We can help you get the Veteran’s DD214 or other discharge documents you may need.

Get more information about planning a buria

If you’re the next of kin of a Veteran who has passed away

You can request a copy of the Veteran’s military records in any of these ways:

Mail or fax a Request Pertaining to Military Records (Standard Form SF 180) to the National Personnel Records Center (NPRC).

Download Form SF 180 (PDF)

Write a letter to the NPRC. Send it to:

1 Archives Drive

St. Louis, Missouri 63138

Visit the NPRC in person

Contact your state or county Veterans agency

Hire an independent researcher

You may be considered the next of kin if you’re related to the Veteran in any of these ways:

Surviving spouse who hasn't remarried, or

Parent, or

Child, or

Sibling

If you’re not the Veteran’s next of kin

If the Veteran was discharged more than 62 years ago, you can order a copy of their military records. The National Archives opens all records to the public 62 years after discharge.

Learn how to access archived records

If the Veteran was discharged less than 62 years ago, you may be able to request limited information from their Military Personnel File.

Find out about general public access to military records

https://www.va.gov/records/get-military-service-records/

Kentucky VA Cash-Out Refinances

|

|

Subscribe to:

Posts (Atom)